In May 2023, the Caixin China General Services PMI recorded a remarkable increase, reaching 57.1 and marking the fifth consecutive month of expansion in the country’s service sector. This article examines the various aspects of this growth, the challenges it faces, and the potential implications for China’s economy and financial markets. Additionally, we provide an outlook on the stock market, explore new possibilities for future growth, compare the current statistics with those of the previous year, and conclude by highlighting the promising path that lies ahead. Furthermore, we analyze the impact of the dollar, debt ceiling concerns, and the rise of Bitcoin on China’s economic landscape.

- Sustained Expansion and Encouraging Market Conditions

- Challenges and the Need for Policy Support

- Tourism Rebounds, but Caution Persists

- Implications for China’s Economy and Financial Markets

- Outlook for the Stock Market: Impact of Dollar, Debt Ceiling, and Bitcoin’s Rise

- Unlocking New Possibilities for Future Growth

- A Comparison with Last Year’s Statistics

- Conclusion: Charting a Promising Path Forward

Sustained Expansion and Encouraging Market Conditions

The Caixin China General Services PMI revealed an impressive expansion in the service sector, reaching 57.1 in May, the second-fastest pace since November 2020. This sustained growth is a testament to China’s resilient post-COVID recovery. New orders experienced significant growth, fueled by improved market conditions and increased customer turnout. Furthermore, export business remained robust. Employment also witnessed a modest climb, and backlogs continued to rise. These positive indicators reflect the resilience and adaptability of the service sector, laying a strong foundation for future growth.

Challenges and the Need for Policy Support

While the service sector’s expansion is encouraging, challenges lie ahead. Domestic consumption, a key driver of economic recovery, is still on the path to full rebound. To address this, policymakers must provide additional support and stimulus measures to boost consumption, corporate profits, people’s income, and fiscal revenue. Balancing the recovery between the services and manufacturing sectors is crucial. Achieving stability and a sustainable rebound will require targeted policies that focus on expanding domestic demand, stabilizing employment, and improving economic expectations.

Tourism Rebounds, but Caution Persists

China’s tourism sector showcased signs of recovery, with domestic travel during the May Day holidays surpassing pre-pandemic levels. However, the second-quarter recovery is expected to moderate, as total consumption value still lags behind pre-COVID levels. This caution stems from the need to nurture sustained growth and overcome remaining headwinds. Continuous efforts to strengthen domestic demand, stabilize employment, and foster positive expectations will be vital in driving the recovery forward.

Implications for China’s Economy and Financial Markets

The expansion of China’s service sector brings forth promising implications for the country’s economy and financial markets, reflecting its resilience and ability to adapt amidst the challenges posed by the COVID-19 pandemic. This development instills confidence in the overall economic recovery, but it is crucial to ensure its stability and sustainability going forward. As we navigate this critical phase, it becomes essential to closely monitor key indicators and ensure that the recovery finds a solid footing.

The Chinese government’s steadfast commitment to supporting the economy through targeted measures that bolster domestic demand will be a key driver in shaping future trends and investor sentiment. By promoting consumer spending, investment, and business growth, policymakers can propel the economy toward a path of robust and balanced expansion. This, in turn, can have positive spillover effects on the financial markets, encouraging investor confidence and facilitating capital flow.

Moreover, as we analyze the evolving economic landscape, it is imperative to take into account various external factors that can impact China’s economic trajectory. The valuation of the dollar, concerns surrounding the debt ceiling, and the growing influence of cryptocurrencies like Bitcoin all warrant careful consideration. These factors can introduce both challenges and opportunities for China’s economy, influencing exchange rates, trade dynamics, and investment flows.

In summary, the expansion of China’s service sector signals a positive outlook for the country’s economy and financial markets. However, vigilance is required to ensure a stable and sustainable recovery. By implementing policies that support domestic demand and addressing external factors, policymakers can navigate the evolving economic landscape and pave the way for continued growth and resilience in the future.

Outlook for the Stock MarketImpact of Dollar, Debt Ceiling, and Bitcoin’s Rise

The positive growth in the service sector and the overall strength of China’s economy are likely to have a favorable impact on the stock market. The surge in employment, increased consumer spending power, and encouraging market conditions create a conducive environment for corporate earnings and market sentiment. However, the stock market’s outlook should be evaluated in the context of potential external factors, such as the value of the dollar, discussions surrounding the debt ceiling, and the rise of cryptocurrencies like Bitcoin. These factors can introduce volatility and uncertainty, requiring investors to stay vigilant and adapt their strategies accordingly.

Unlocking New Possibilities for Future Growth

The continued expansion of China’s service sector not only signifies its present success but also holds the key to unlocking a multitude of new possibilities for future growth. As market conditions improve and consumer confidence rises, the stage is set for innovative ideas, entrepreneurial ventures, and the emergence of new services tailored to meet the evolving needs and preferences of Chinese consumers. This presents an exciting opportunity for businesses to tap into untapped markets, create value, and drive economic growth.

To fully capitalize on these prospects, it is essential for policymakers and industry leaders to adopt a forward-thinking approach. By implementing targeted policies and making strategic investments, the service sector can bolster its role as a significant contributor to China’s overall economic prosperity. Embracing digitalization, sustainable practices, and technology-driven solutions will be paramount in unlocking the sector’s true potential.

Digital transformation will play a pivotal role in shaping the future of the service sector. Leveraging technological advancements and embracing digital platforms can streamline processes, enhance efficiency, and deliver seamless customer experiences. This includes leveraging e-commerce, mobile applications, and emerging technologies like artificial intelligence and blockchain to provide innovative solutions and personalized services.

Furthermore, sustainability will be a crucial aspect of future growth in the service sector. By prioritizing environmentally friendly practices, businesses can not only meet the growing demand for sustainable products and services but also contribute to the long-term well-being of the planet. Embracing sustainable business models, reducing carbon footprints, and adopting green practices will not only attract environmentally conscious consumers but also position companies as responsible corporate citizens.

In summary, the sustained expansion of China’s service sector opens up a world of new possibilities for future growth. By embracing digitalization, sustainable practices, and innovation, businesses can thrive in the evolving market landscape and contribute to China’s economic success. It is through strategic investments and a proactive approach that the service sector can unlock its full potential and shape the trajectory of China’s economic growth in the coming years.

A Comparison with Last Year’s Statistics

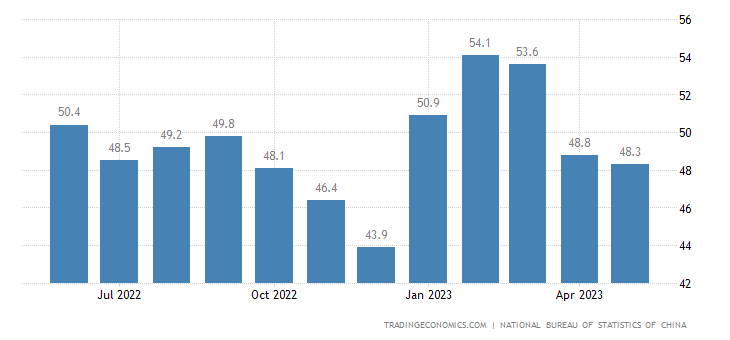

Let’s take a moment to compare the current statistics of China’s service sector with those from the previous year. This comparison gives us valuable insights into the progress that has been made and the remarkable resilience displayed by the sector in the face of challenging times. Despite the uncertainties and disruptions caused by the pandemic, the service sector has shown its ability to bounce back and adapt to the changing landscape.

Looking back at the previous year, we can see how far the service sector has come on its path to recovery. It’s truly impressive to witness the determination and tenacity of businesses operating in this sector as they navigate through the hurdles. Their efforts have paid off, and we can clearly see the positive trajectory of the sector’s rebound.

This comparison not only highlights the sector’s resilience but also points to the potential for future growth. It’s a testament to the sector’s ability to adapt and seize opportunities in the ever-changing business environment. By examining the patterns and trends revealed in this comparison, we can identify areas of strength and areas that require further attention. This analysis will guide us in formulating strategies and policies that foster continued growth and ensure the sector’s long-term sustainability.

Conclusion: Charting a Promising Path Forward

The sustained expansion of China’s service sector, as indicated by the Caixin China General Services PMI, reflects the country’s resilience and adaptability. This growth is underpinned by encouraging market conditions, increased employment, and rising customer turnout. To ensure a stable and sustainable recovery, policymakers must provide targeted support to boost domestic demand and economic expectations. The positive outlook for the stock market, along with new possibilities for future growth, adds to the overall optimism surrounding China’s economic landscape. By navigating challenges and capitalizing on opportunities, China’s service sector can chart a promising path forward, contributing to the nation’s continued economic success.

2 thoughts on “China’s Service Sector Growth: Resilience, Opportunities, and Outlook for the Stock Market”