Introduction

In the intricate world of finance, where every move can either bolster or jeopardize your financial standing, one must tread cautiously, akin to a seasoned tightrope walker navigating a high wire. The stock market, a captivating arena of wealth and woe, beckons astute investors to decipher its cryptic dance, seeking opportunities that can unlock the gates to financial prosperity. In this quest for fiscal ascension, two captivating equities come into the spotlight – Buy these stocks Citigroup and AT&T, stars that twinkle with potential in the vast galaxy of investment.

Understanding Citigroup’s Prospects

Citigroup, a veritable titan in the realm of banking, boasts a storied history that traces its roots back to the early 19th century. This venerable institution has withstood the tumultuous gales of financial tempests, a testament to its resilience and adaptability. An investment eyeing Citigroup is akin to setting sail with a seasoned mariner, charting a course through economic seas with the wind at your back.

The very bedrock of Citigroup’s appeal lies in its awe-inspiring market capitalization and the unwavering stability of its balance sheet. These pillars provide a formidable foundation upon which dreams of growth and prosperity are constructed. The numbers align, the stars converge, and as of our most recent analysis, Citigroup stands on the precipice of a lucrative ascent.

The orchestration of Citigroup’s success can be attributed to its strategic embrace of digitalization and technology. In an era where financial landscapes evolve at the blink of an eye, Citigroup remains a trailblazer. The bank’s resolute focus on technology ensures it is perpetually poised for battle in this ever-shifting financial battlefield.

With prudence and vision, wise investors turn their gaze towards Citigroup, for it is a beacon in the night, guiding them towards the shores of financial triumph. In this intricate dance of finance, Citigroup takes the stage, ready to play its part in the symphony of prosperity for those who dare to invest in its future.

AT&T: A Telecommunication Giant in Transition

AT&T, a colossus in the ever-evolving telecommunications domain, beckons investors with a siren’s call, promising an odyssey through the labyrinthine possibilities of the stock market. This illustrious company’s tale is woven into the very fabric of the telecom narrative, an enduring protagonist shaping the industry’s storyline.

AT&T’s history is not just a chronicle; it’s an epic. It has etched its name into the annals of telecom history, an enduring monument to innovation and transformation. A diligent investor’s curiosity is piqued, and rightfully so, for AT&T’s narrative is a tapestry of change and evolution.

In recent chapters, AT&T’s transformative voyage continues, a testament to its enduring relevance in the fast-shifting currents of the market. The acquisition of Time Warner has not merely expanded AT&T’s horizons; it has forged an empire in the realm of media. This strategic maneuver is the orchestra’s crescendo, a resounding harmony of diversification and adaptation to the ever-revolving market dynamics. The river of revenue has branched into new streams, fertile grounds for investment aspirations to flourish.

But AT&T’s quest for innovation doesn’t stop with media magnificence. In the midst of this great transition, AT&T steers its ship toward the future, embracing next-generation technologies like the heralded 5G networks. The horizon beckons, and AT&T stands ready to seize the opportunities of an increasingly digital world.

For those investors looking to navigate the intricate tides of the telecommunications sector, AT&T emerges as a lighthouse, casting its beacon upon the uncharted waters. The company’s unwavering commitment to diversification, innovation, and readiness for the digital age makes it a tantalizing option for those who seek to invest in the next chapter of this captivating saga.

Analyzing the Financial Performance

Before you buy these stocks, a thorough analysis of the financial performance is essential. Citigroup and AT&T both exhibit strengths and weaknesses in this regard. Let’s delve into their respective financials to help you make an informed decision.

Citigroup’s Financial Health

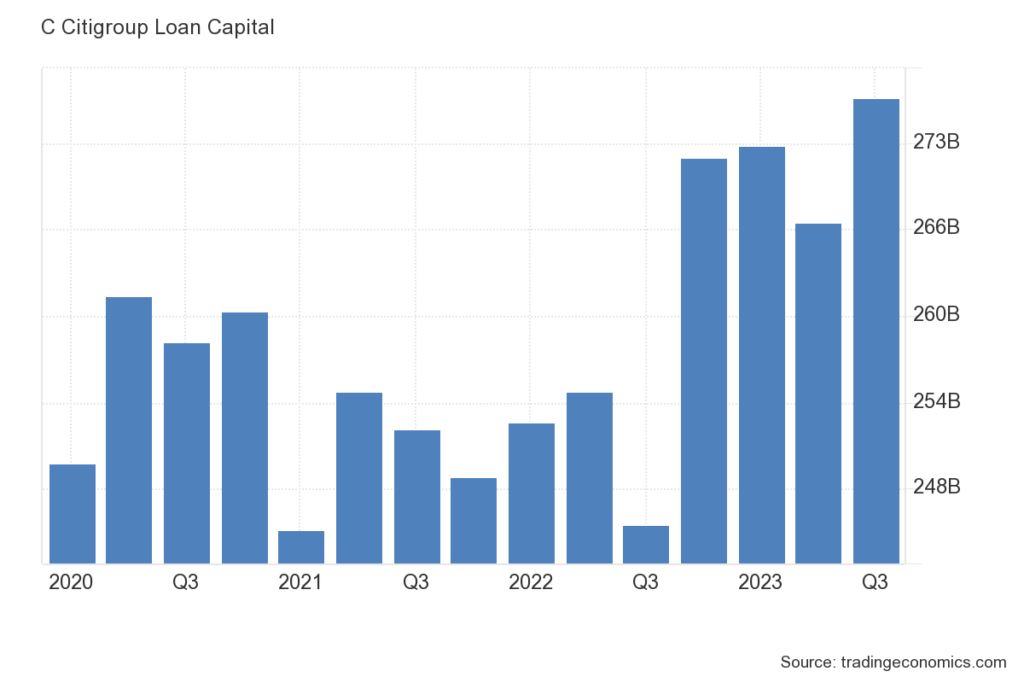

Citigroup’s financial performance, akin to a seasoned oak tree, stands as a symbol of stability and resilience in the tumultuous forest of finance. With a market capitalization that stretches beyond the $150 billion mark, it’s not merely a financial institution; it’s a formidable fortress. Its balance sheet, resembling the bulwarks of a castle, houses substantial assets, and its revenue streams meander like a mighty river, diversifying the sources of its strength.

In recent chapters of Citigroup’s saga, a strategic metamorphosis has been underway, as the bank trims its sails and sheds non-core businesses. The symphony of this transformation enhances the bank’s efficiency, akin to a conductor refining the orchestra for a flawless performance. In the intricate dance of finance, this shift is paramount, for an efficient, lean Citigroup is better equipped to brave the tempestuous seas of economic challenges.

As you consider these stocks, Citigroup’s financial backdrop emerges as a mural of resilience and promise. A fortress that has weathered many storms, it stands as a beacon for those who seek financial strength in an ever-changing world.

AT&T’s Financial Fortitude

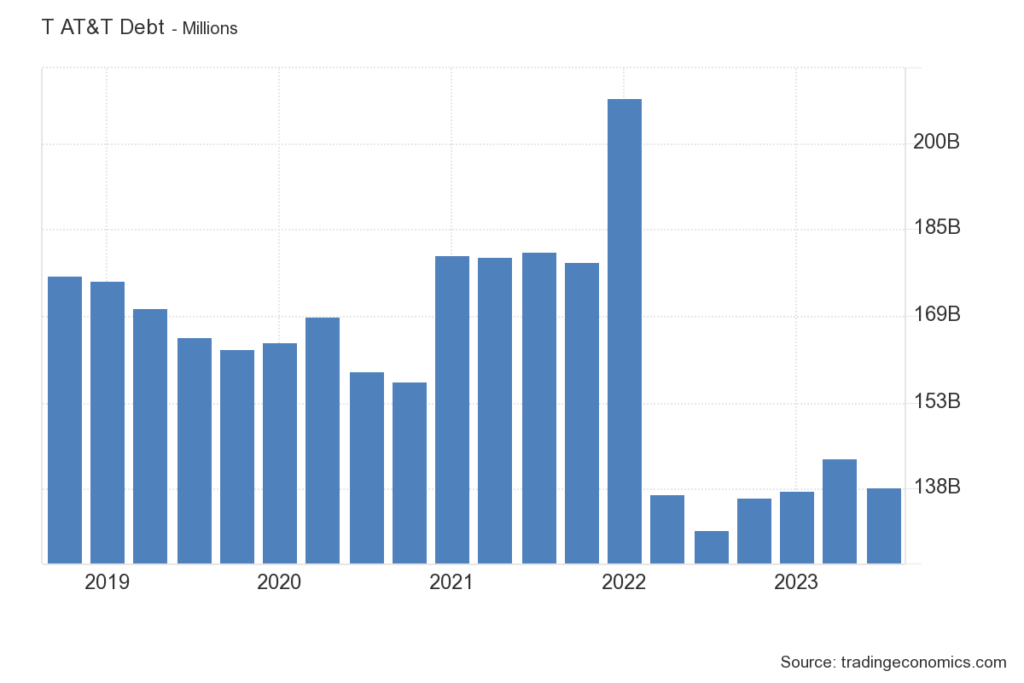

AT&T, though it may not boast the towering market capitalization of Citigroup, strides confidently in the financial arena. The acquisition of Time Warner has fortified its financial ramparts and painted a canvas of diversification, ensuring its revenue sources flow like a mighty river with multiple tributaries. This diversification, akin to a shield, bestows upon AT&T the resilience and stability that every prudent investor seeks.

Yet, as the keen-eyed observer delves into AT&T’s financial manuscript, a notable chapter emerges – the substantial debt load, largely stemming from the Time Warner acquisition. It’s a note in the symphony, an element of discord, but it’s not without counterbalancing forces. AT&T’s cash flow and revenue streams, like a protective armor, stand as a buffer against potential risks.

When contemplating whether to seize these stocks, the debt in AT&T’s ledger should not be taken lightly. It is a part of the story, a subplot that demands attention. However, in the grand narrative of AT&T’s financial strength, it’s but a note in the score, one that prudent investors must weigh against the grand symphony of diversification and resilience.

Investment Strategies

Now that we’ve examined the financial standing of Citigroup and AT&T, let’s explore some investment strategies to optimize your returns when you buy these stocks.

Diversification and Risk Mitigation

Indeed, diversification is a fundamental principle of risk management in the world of investments. When considering the acquisition of stocks like Citigroup and AT&T, weaving them into a diversified portfolio is akin to crafting a financial safety net.

The core idea of diversification is to avoid putting all your financial assets into a single basket. By spreading your investments across different sectors, you create a robust shield against the whims of individual stocks or industries. In this context, Citigroup’s presence in the financial sector harmonizes beautifully with AT&T’s role in telecommunications and media.

The financial sector, represented by Citigroup, can offer exposure to the broader economy, while the telecommunications and media sector, embodied by AT&T, provides a different set of dynamics. The amalgamation of these two stocks in your portfolio forms a symphony of diversification, making it less vulnerable to the idiosyncrasies of a single sector.

As the financial markets ebb and flow, the power of diversification comes to the fore. When one sector experiences a downturn, another may thrive, helping to balance the scales. This not only mitigates risks but can also enhance the potential for stable, long-term returns.

In the complex choreography of investments, diversification is the graceful pirouette that ensures your financial dance remains harmonious. So, when you buy these stocks, consider not just the individual merits of Citigroup and AT&T but also how they complement each other within your diversified portfolio. This synergy can provide a stable foundation for your financial journey, helping you navigate the intricacies of the market with greater confidence.

Long-Term vs. Short-Term Investment

Your investment horizon, much like the captain’s compass, guides your course through the turbulent waters of the financial world. It’s a critical factor when deciding whether to buy stocks like Citigroup and AT&T, for these two companies are like stars that shine with different intensities across the night sky of investments.

For those with a long-term perspective, AT&T beckons like a steady lighthouse on a distant shore. Its history of consistent dividend payments and the potential for capital appreciation make it an enticing choice. AT&T’s presence in the media and telecommunications sectors ensures that it remains a relevant player in the long-run narrative of the market. It’s a stock to consider if you seek a dependable anchor in your portfolio, knowing that time may be your greatest ally.

Conversely, Citigroup emerges as a prospect for those with a patient outlook, desiring growth over the long term. The bank’s focus on digital transformation and innovation is a testament to its forward-looking approach. In the ever-evolving world of finance, adaptability is the key to survival, and Citigroup’s readiness to embrace change positions it as a solid choice for investors who are willing to take a longer and potentially more rewarding journey.

In the tapestry of investments, your choice between these stocks depends not just on their individual merits but also on the canvas of your investment horizon. Do you seek steady and reliable returns over time, or are you willing to wait for the seeds of innovation to bloom into substantial growth? Consider your time frame, and let it be your guiding star as you navigate the celestial expanse of investment opportunities.

Monitoring and Adjusting Your Portfolio

Once you decide to buy these stocks, your journey doesn’t end there. Regularly monitoring your investments and adjusting your portfolio is critical. Markets are dynamic, and a stock’s performance can change rapidly.

Consider employing stop-loss orders to limit potential losses and lock in profits. Keep an eye on macroeconomic factors, industry trends, and the financial performance of Citigroup and AT&T. This proactive approach can help you make informed decisions regarding your investments.

Conclusion

In conclusion, Citigroup and AT&T are compelling options for investors looking to buy these stocks for enhanced returns. Both companies bring distinct strengths to the table, making them valuable additions to a diversified portfolio. Your investment strategy should align with your financial goals, risk tolerance, and investment horizon.

Citigroup’s embrace of technology and innovation positions it for long-term growth, while AT&T’s diversification and media presence make it a stable choice. Whichever path you choose, remember that a well-informed and proactive approach to investment is crucial for success.

Investing in stocks is not without risk, and market conditions can change rapidly. It’s advisable to consult with a financial advisor and conduct thorough research before making investment decisions. By staying informed and being strategic in your investments, you can maximize your chances of realizing enhanced returns when you buy these stocks.