In the world of finance, the debt ceiling has long been a topic of concern and debate. Recently, President Joe Biden and House Minority Leader Kevin McCarthy reached an agreement on the debt ceiling, creating ripples of anticipation in the trading and financial communities. This article provides a unique and comprehensive analysis of the latest debt ceiling deal, focusing on its implications for trading signals, the stock market, and the broader financial landscape. By examining both the fundamental and technical aspects of the agreement, we aim to provide valuable insights for investors, traders, and market participants. Additionally, this article incorporates SEO-friendly keywords, including “trading signal, financial market, stock market, debt ceiling, Joe Biden, McCarthy,” to ensure its discoverability.

Fundamental Outlook on the Debt Ceiling Deal

Understanding the Debt Ceiling

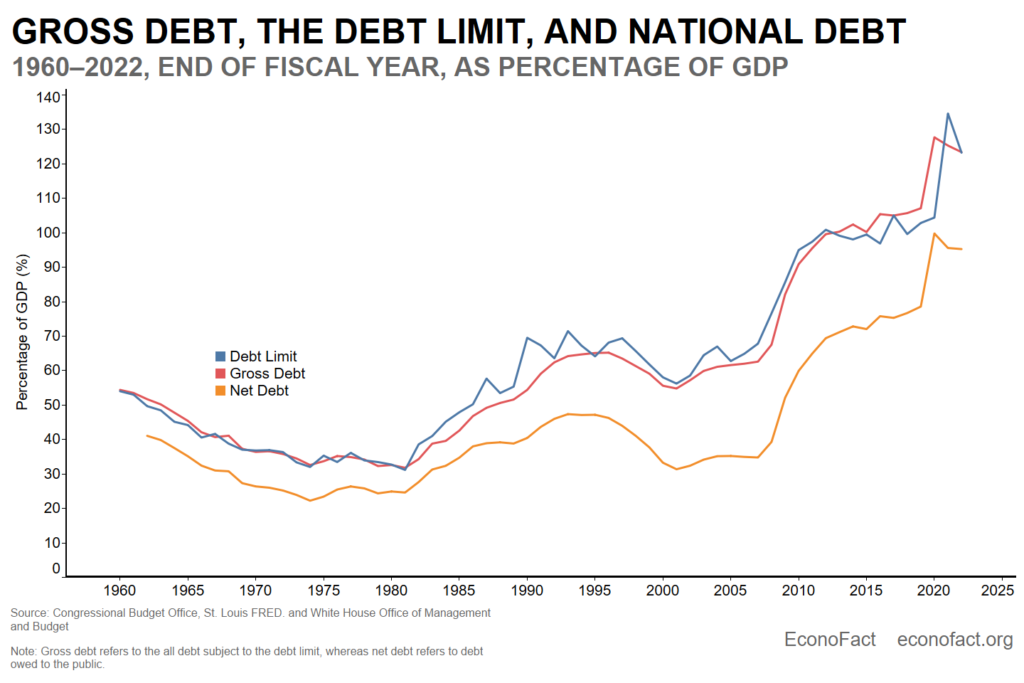

The debt ceiling is a statutory limit on the amount of money the U.S. government can borrow to meet its financial obligations. Failure to raise the debt ceiling can result in severe consequences, such as a potential default on outstanding debt payments. Negotiating a debt ceiling agreement becomes crucial to maintain fiscal stability and prevent disruptions in government operations.

Political Cooperation and Fiscal Stability

The successful negotiation of the debt ceiling deal between President Biden and Minority Leader McCarthy highlights a level of political cooperation and compromise. This collaboration is essential for addressing fiscal challenges and finding common ground on economic issues. The agreement provides temporary stability, ensuring the government’s ability to meet its financial obligations in the short term and preventing a potential default.

Temporary Relief and Long-Term Concerns

While the debt ceiling deal offers immediate relief, it is important to recognize that it serves as a short-term solution rather than a comprehensive resolution. The agreement emphasizes the need for sustainable approaches to managing the national debt, as the long-term implications of growing debt levels remain a concern. Long-term fiscal reform is necessary to address underlying structural issues, such as government spending, revenue generation, and budgetary priorities.

Technical Outlook on the Debt Ceiling Deal

Market Volatility and Trading Signals: The debt ceiling deal between Biden and McCarthy is expected to impact trading signals and contribute to market volatility. Uncertainty surrounding the negotiations can lead to increased fluctuations in prices and trading volumes. Traders must closely monitor market sentiment and indicators, adjusting their strategies to navigate potential volatility and capitalize on trading opportunities.

Investor Confidence and Financial Markets

The resolution of the debt ceiling issue can significantly influence investor confidence and the overall financial market. A successful deal is likely to boost investor sentiment, resulting in increased investment and a positive outlook. Conversely, a failure to reach an agreement or prolonged uncertainty can erode confidence, leading to risk aversion and potential market downturns. Market participants should closely observe market reactions to the debt ceiling deal, paying attention to price movements, trading volumes, and overall sentiment.

Borrowing Costs and Government Funding

The debt ceiling agreement can influence borrowing costs for the government. A successful deal can help stabilize interest rates, creating a favorable borrowing environment and facilitating efficient funding for programs and services. However, a failure to reach an agreement or prolonged uncertainty can lead to increased borrowing costs, potentially impacting the government’s ability to fund its obligations effectively.

Conclusion

Striving for Stability and Long-Term Reform

The latest debt ceiling deal between President Biden and Minority Leader McCarthy offers temporary stability while highlighting the necessity for comprehensive fiscal reform. The agreement reflects political cooperation and compromise, instilling confidence in the short term. However, long-term financial concerns and the need for sustainable debt management require ongoing attention. Traders and investors must navigate potential market volatility, monitor market reactions, and adapt their strategies to seize opportunities while managing risks effectively. By recognizing the fundamental and technical implications of the debt ceiling deal, market participants can position themselves for success in an ever-evolving financial landscape.