Introduction

In the ever-evolving landscape of the global economy, the decisions made by central banks ripple across financial markets and touch the lives of individuals worldwide. One such pivotal institution, the Bank of England, faced a momentous choice during its November meeting. The bank maintained its benchmark interest rate at a 15-year high of 5.25% for the second consecutive time, amid recent indications of an economic slowdown in the UK and the persistent challenge of soaring inflation. The Monetary Policy Committee, with a split vote of 6-3, opted to keep rates unchanged, with three members advocating for a modest 25 basis points increase. This decision not only affects the British economy but also carries implications for global financial stability.

Understanding the Bank of England’s Decision

The Bank of England’s recent decision to stick with the status quo speaks volumes when we dive into the intricacies of their recent policy maneuvers. It’s like they’re trying to whisper something to us through the corridors of economic jargon. What’s really going on here is that they’re dancing the tightrope between growth and price stability, and they’re doing it with grace.

This isn’t just any old decision. It’s a careful, calculated move. It’s a bit like watching a seasoned tightrope walker, making sure every step is measured and deliberate. The central banks of the world have a reputation for this kind of cautiousness. They’re the maestros of the financial symphony, and they understand the complexity of the economic environment we’re in.

So, when the Bank of England decides to keep things as they are, it’s not just a random choice. It’s a strategic move in the grand economic chess game. They’re telling us that they’ve weighed the options, considered the risks, and they’re playing it safe. In a world where every financial ripple can create waves, this careful approach is like a soothing melody in the midst of economic chaos.

The Bank’s Interest Rate Dilemma

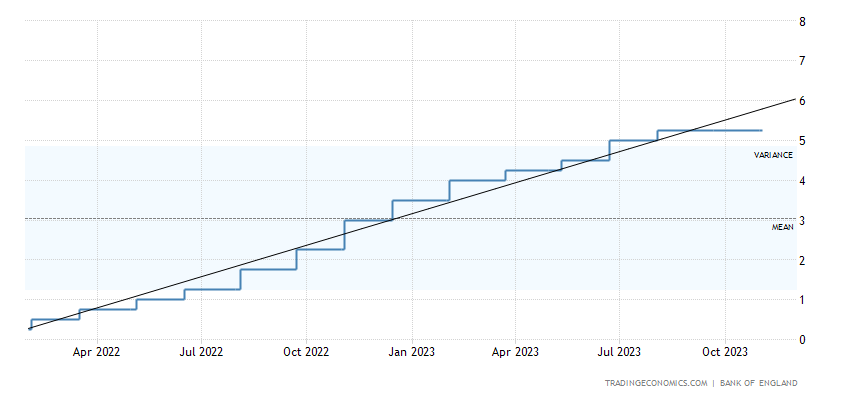

The benchmark interest rate, standing at 5.25%, is a reflection of the Bank of England’s ongoing attempt to navigate through the turbulent waters of the UK economy. The decision to hold this rate comes as policymakers assess the signs of a potential economic slowdown. Simultaneously, they grapple with the challenge of stubbornly high inflation. Inflation is a cause for concern not only in the UK but across the globe. It erodes the purchasing power of consumers and can lead to market instability.

The Split Decision

The Monetary Policy Committee’s split vote, with six members opting to maintain the rate and three advocating for a modest increase, highlights the complexities surrounding monetary policy. This divergence of opinions within the committee reveals the delicate balance the bank must strike between boosting economic growth and reining in inflation. The Bank of England’s policymakers are essentially walking a tightrope, aiming to prevent the economy from stalling while avoiding runaway price increases.

A Proactive Approach to Inflation

In their official statement, the central bank made it crystal clear that they’re planning to keep monetary policy on a tight leash for quite a while. It’s like they’ve hoisted a bright warning flag, and the message is loud and clear: taming inflation is at the forefront of their agenda. The Bank of England’s dedication to that sacred 2% inflation goal remains steadfast, unwavering in the face of economic winds.

This commitment is not just some passing fancy; it’s rooted in the fundamental principle of central banking. They know that maintaining price stability is the bedrock of a healthy economy. It’s the cornerstone on which prosperity is built. So, when the Bank of England reaffirms its devotion to this principle, it’s akin to a pledge to safeguard the economic well-being of the nation.

Revised Inflation Projections

In a move that caught the attention of financial markets and economists, the Bank of England revised its inflation projections slightly higher. This adjustment underscores the bank’s dedication to transparency and its willingness to adapt to changing economic conditions. It also reflects the inherent challenges of forecasting in a dynamic economic environment.

GDP Growth Forecasts

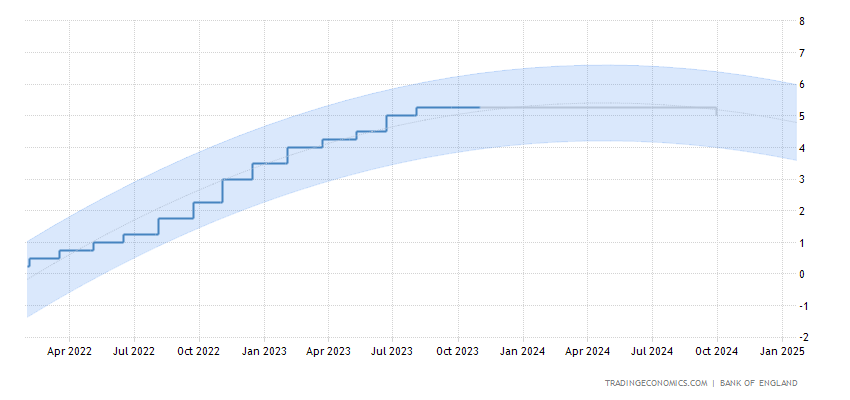

The GDP growth forecasts handed down by the Bank of England cast a rather cautious and even somewhat gloomy shadow on the economic landscape. It’s like they’re presenting a weather report for the economy, and the forecast isn’t exactly sunshine and rainbows. According to their predictions, it appears that the UK economy hit a bit of a standstill in the last quarter, and the prospects for the final three months of the year don’t look much better, with growth expected to be on the modest side.

This subdued growth outlook is a mirror reflecting the pervasive uncertainty that has swept across global markets in recent times. It’s as if the whole financial world is caught in a fog, making it difficult to see what lies ahead. The Bank’s cautious numbers align with this worldwide climate of uncertainty, highlighting the challenges and headwinds that the economy is currently navigating.

Advice for Investors

For investors, the Bank of England’s decision should serve as a reminder of the ever-present volatility in financial markets. It’s essential to stay informed about central bank policies and how they can impact your investments. Diversification and a long-term perspective remain valuable strategies for navigating market fluctuations.

Balancing Act: Navigating Economic Slowdown and Inflation

The Bank of England’s decision is indicative of the global economic conundrum – the simultaneous existence of an economic slowdown and persistently high inflation. This balancing act is not unique to the UK; it’s a challenge that central banks across the world are grappling with. The Bank of England’s approach can serve as a case study in the complexity of monetary policy in the modern era.

Conclusion

The Bank of England’s decision to maintain its benchmark interest rate at 5.25% is more than a simple policy choice; it’s a reflection of the intricate dance central banks must perform to safeguard economic stability. The global economy’s future trajectory remains uncertain, and the Bank of England’s cautious approach underscores the need for a steady hand at the helm. In these challenging times, staying attuned to central bank decisions and economic developments is essential for both investors and the broader public. The Bank of England, in its role as a guardian of financial stability, continues to be a central player in the evolving narrative of the global economy, and its actions will continue to shape our financial landscape in the coming months.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.