The Dollar Index Signal Unveiled

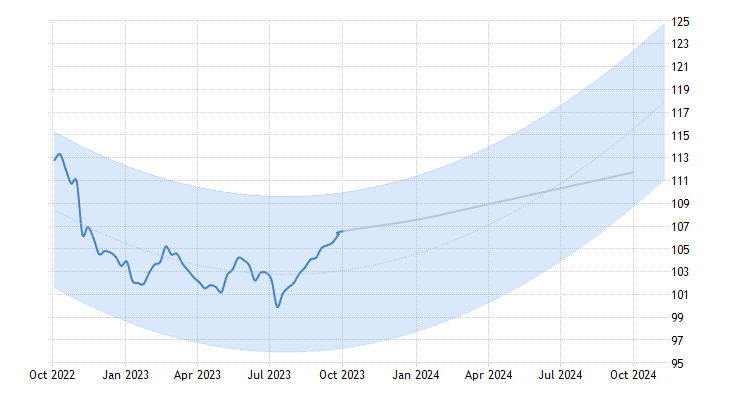

In the dynamic world of global finance, few indicators capture the attention of traders and investors quite like the Dollar Index Signal. As of Wednesday, the dollar index remained relatively stable at 107, a level reminiscent of its highs last observed in November the previous year. This stability follows a period of economic data that has left market participants in a state of anticipation, navigating through a maze of mixed signals. In this extensive analysis, we delve into the intricacies of the dollar’s recent performance, dissecting key economic metrics and the broader market sentiment. Our objective is to provide clarity in understanding the forces that shape the dollar’s trajectory.

The Tale of Mixed Economic Data

The Dollar Index Signal, reflecting the strength of the US dollar against a basket of major currencies, has recently been influenced by a tapestry of economic reports. First and foremost, the ISM Services PMI signaled a slowing pace of growth in the services sector, though it still remained robust. Simultaneously, factory orders exceeded expectations, painting a picture of surprising resilience. Conversely, the ADP report cast a shadow by revealing that the US private sector added the fewest jobs since January 2021, suggesting a potential cooling of the labor market. This report was in stark contrast to the JOLTS report, which, earlier in the week, showed an unexpected surge in job openings in August. Meanwhile, the ISM Manufacturing PMI for September hinted at the smallest contraction in factory activity in nearly a year.

Navigating Uncertainty

The Dollar Index Signal is also significantly influenced by the utterances of Federal Reserve officials. Their recent hawkish comments have heightened expectations that borrowing costs will remain elevated for an extended period. This prospect, in turn, has implications for the greenback’s performance. With interest rates playing a pivotal role in currency valuation, the specter of higher borrowing costs can potentially strengthen the dollar. However, this shift could also hinder economic growth, as it may deter borrowing and spending.

Dollar Index and International Relations

Beyond economic data and monetary policy, the Dollar Index Signal is sensitive to geopolitical developments and international relations. The dollar’s position as the world’s primary reserve currency means that its value is intricately tied to global events. Geopolitical tensions, trade disputes, and diplomatic relations all contribute to the dollar’s performance. For instance, trade tensions between the United States and China have historically put downward pressure on the dollar, as uncertainty in the global trade landscape can erode investor confidence in the currency.

A Global Perspective

Expanding our perspective globally, it’s crucial to acknowledge that the dollar index is not merely a reflection of the US economy. Other major economies also play a significant role in shaping its trajectory. The euro, pound, and Aussie have all influenced the dollar’s recent performance. While the greenback exhibited slight weakness against these currencies, the yen remained below the 150 threshold. This complex interplay of currencies underscores the interconnectedness of the global financial system and its impact on the Dollar Index Signal.

Investor Strategies in a Volatile Market

Given the mixed signals and the ever-evolving landscape, investors must tread carefully in the current environment. A well-thought-out strategy is essential to navigate the uncertainties surrounding the Dollar Index Signal. Diversification across asset classes and currencies can provide a hedge against currency risk. Additionally, staying informed about global economic developments, central bank policies, and geopolitical events is crucial for making informed decisions.

Conclusion

In conclusion, the Dollar Index Signal is a multifaceted indicator influenced by a myriad of factors, including economic data, monetary policy, international relations, and global market dynamics. Its recent stability at 107, near November 2022 highs, is a testament to the intricate web of forces at play. As investors and traders navigate this complex landscape, it is imperative to remain vigilant and adaptable, adjusting strategies in response to evolving market conditions. By staying informed and maintaining a diversified portfolio, market participants can better position themselves to harness the opportunities and mitigate the risks associated with the Dollar Index Signal.

mexican pharmaceuticals online

http://cmqpharma.com/# medication from mexico pharmacy

medicine in mexico pharmacies

mexico drug stores pharmacies: mexican pharmacy – reputable mexican pharmacies online

medicine in mexico pharmacies: online mexican pharmacy – mexican mail order pharmacies

best rated canadian pharmacy: canadian drug stores – reliable canadian pharmacy

https://foruspharma.com/# medication from mexico pharmacy

canada rx pharmacy: canada rx pharmacy world – pharmacy in canada

buying prescription drugs in mexico online: reputable mexican pharmacies online – mexican pharmacy

http://canadapharmast.com/# canadian world pharmacy

canadianpharmacyworld canadian discount pharmacy ed meds online canada

mexican pharmaceuticals online pharmacies in mexico that ship to usa buying prescription drugs in mexico

my canadian pharmacy review: canadian drug stores – legitimate canadian pharmacies

mail order pharmacy india: Online medicine order – best india pharmacy

http://foruspharma.com/# buying prescription drugs in mexico online

best india pharmacy: india online pharmacy – world pharmacy india

mexican border pharmacies shipping to usa buying prescription drugs in mexico online reputable mexican pharmacies online

pharmacies in mexico that ship to usa: mexican pharmacy – п»їbest mexican online pharmacies

mexican pharmaceuticals online: mexican drugstore online – mexico drug stores pharmacies

mexican mail order pharmacies: buying from online mexican pharmacy – buying from online mexican pharmacy

https://canadapharmast.online/# best canadian pharmacy online

top 10 online pharmacy in india indian pharmacies safe india pharmacy

canadian pharmacy phone number: canadian drugs pharmacy – legitimate canadian pharmacies

Online medicine home delivery: top 10 online pharmacy in india – buy medicines online in india

https://foruspharma.com/# mexican drugstore online

canadianpharmacy com ed drugs online from canada is canadian pharmacy legit

canada pharmacy reviews: canadian pharmacy king reviews – canadian drug stores

canadian pharmacy ltd: canadian pharmacy – canada pharmacy reviews

mexican drugstore online: mexico pharmacies prescription drugs – mexican mail order pharmacies

https://doxycyclinedelivery.pro/# doxycycline 1000mg best buy

doxycycline generic cost: doxycycline price uk – doxycycline hyclate 100mg price

https://ciprodelivery.pro/# ciprofloxacin

doxycycline buy no prescription doxycycline tetracycline can you buy doxycycline over the counter in south africa

canadian pharmacy doxycycline: doxycycline 1mg – doxycycline 100mg tablets for sale

https://clomiddelivery.pro/# cost of generic clomid

http://clomiddelivery.pro/# how to get cheap clomid pills

http://amoxildelivery.pro/# amoxicillin for sale online

buy doxycycline online 270 tabs doxycycline 100mg cost doxycycline for sale online

https://doxycyclinedelivery.pro/# doxycycline 100mg generic

doxycycline india pharmacy: doxycycline 150 mg capsules – where to buy doxycycline online

https://paxloviddelivery.pro/# Paxlovid over the counter

http://paxloviddelivery.pro/# Paxlovid over the counter

http://clomiddelivery.pro/# can you buy cheap clomid no prescription

ciprofloxacin ciprofloxacin mail online ciprofloxacin generic

amoxicillin 500 mg capsule: amoxicillin without a prescription – amoxicillin 500mg over the counter

https://doxycyclinedelivery.pro/# doxycycline medication

http://amoxildelivery.pro/# amoxicillin 500mg price canada

https://clomiddelivery.pro/# can i order generic clomid without dr prescription

buy cipro online canada buy cipro cheap cipro ciprofloxacin

paxlovid buy: Paxlovid over the counter – buy paxlovid online

http://paxloviddelivery.pro/# paxlovid generic

http://paxloviddelivery.pro/# paxlovid pill