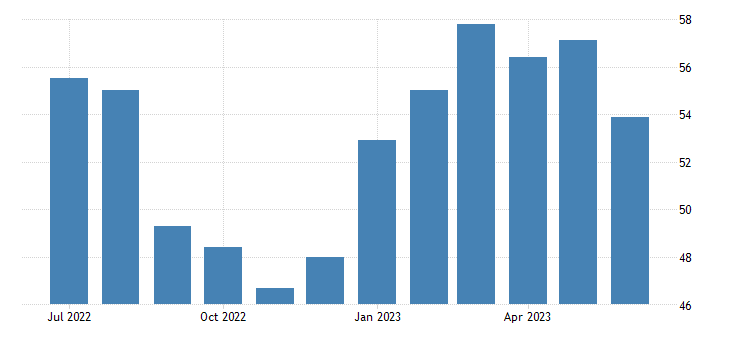

In June 2023, the Caixin China General Services Purchasing Managers’ Index (PMI) reported a slight decline, falling to 53.9 from the previous month’s reading of 57.1. This reading suggests that the services sector in China experienced its sixth consecutive month of expansion, albeit at a slower pace since January. The moderation in demand contributed to a decline in new orders, which reached a six-month low. However, despite this softening, the report indicates that the new export business continued to grow solidly, although the rate of increase dipped to its lowest level since January. Additionally, employment in the sector showed encouraging signs, with job creation witnessing its strongest growth in three months. This analysis delves deeper into the components of the PMI, including new orders, employment, pricing dynamics, and business sentiment, offering insights into China’s economic conditions and prospects for future growth.

New Orders and Export Business: China PMI

The report highlights a decline in new orders, reaching a six-month low during June 2023. This indicates a potential decrease in demand for services in China. However, despite this moderation, the export business segment remained resilient, displaying solid growth. Exporters in China continued to receive orders from overseas markets, contributing positively to the overall service activity. While the rate of increase in export business has softened since January, this segment continues to serve as a vital driver of growth for the Chinese services sector. The steady expansion in the export business provides a silver lining amidst the challenges posed by the moderated domestic demand, indicating that China’s services industry still holds promise for international trade and global engagement.

Employment Growth and Job Creation:

June 2023 brought forth an encouraging revelation in the PMI report, shedding light on the sustained growth in employment for the fifth consecutive month. This news is a testament to the resilience and potential of the services sector in China, as it paves the way for increased job opportunities. What’s even more remarkable is that the rate of job creation in June reached its highest point in three months, indicating a strong belief among businesses in their future growth prospects and a genuine eagerness to expand their workforce.

This noteworthy trend underscores the pivotal role played by the services sector in shaping China’s employment landscape. As this sector continues its expansion, it not only creates employment opportunities but also bolsters the nation’s economic growth by fostering greater consumer spending and enhancing overall productivity. The significance of this sector cannot be overstated, as it not only serves as a vital source of livelihood but also acts as a driving force behind the country’s economic prosperity.

Pricing Dynamics and Cost Pressures:

The June 2023 PMI report sheds light on the pricing dynamics within the services sector, revealing a robust increase in input prices. This upward trend can be attributed to two key factors: the rising costs of staffing and the higher prices of raw materials. The ongoing challenges of attracting and retaining skilled labor have exerted upward pressure on input prices, further compounded by the broader impact of inflationary pressures.

Nevertheless, it’s important to highlight that the increase in output costs was only marginal. This suggests that businesses operating in the services sector have encountered formidable competition, which has limited their ability to fully transfer the burden of cost increases to their customers. While this may put pressure on profit margins, it also signifies the existence of a competitive market environment. These competitive market conditions, in turn, work to the advantage of consumers by promoting relatively stable pricing. Thus, while businesses navigate the challenges of cost escalation, consumers can benefit from a more favorable pricing landscape.

Business Sentiment and Growth Prospects:

In June 2023, a ray of hope illuminated the business landscape as the tides of business sentiment began to shift, breaking free from a five-month period of decline. This uplifting change can be attributed to the anticipation of stronger economic conditions and the exciting prospects of new work that will foster growth. Among service providers in China, cautious optimism has emerged, signaling their confidence in the future and their eagerness to seize the opportunities that lie ahead.

The improved business sentiment reveals a delicate balance between hope and prudence. Service providers, keenly aware of the challenges they have faced, now find themselves cautiously optimistic, believing in the potential for a more favorable business environment in the near future. This positive outlook is undoubtedly influenced by a multitude of factors, including the supportive policies implemented by the government, the evolving global economic trends, and the gradual recovery from the far-reaching impacts of the pandemic.

As this wave of positive sentiment continues to gain momentum, its transformative power becomes evident. It has the potential to fuel investments, spark innovation, and inject renewed vigor into the services sector. This, in turn, will contribute to the overall economic growth of China, propelling the nation forward on its path toward a brighter and more prosperous future.

Conclusion: China PMI

The Caixin China PMI for June 2023 presents a nuanced picture of the services sector in China. Despite moderation in demand, the sector continued its expansion for the sixth consecutive month, albeit at a slower pace since January. The decline in new orders was offset by solid growth in the export business, signaling China’s continued engagement with international markets. Employment growth remained robust, with job creation reaching its highest level in three months, underscoring the sector’s importance as a driver of employment and economic vitality. Pricing dynamics revealed elevated input costs, while strong competition limited the pass-through to output costs. Finally, the improvement in business sentiment provides a glimpse of optimism for the future, as service providers anticipate stronger economic conditions and increased opportunities for growth. Overall, the Caixin China General Services PMI for June 2023 points to a resilient services sector in China, with potential for further expansion and positive

3 thoughts on “Analyzing the Caixin China Services PMI for June 2023: Signs of Moderate Expansion Amidst Softening Demand”