Introduction

In the dynamic world of finance, the U.S. dollar plays a pivotal role as a global reserve currency and a barometer of economic health. The U.S. Dollar Index (USDX) serves as a valuable tool for traders and investors, offering insights into the dollar’s performance against a basket of major currencies. In this comprehensive article, we will explore the U.S. Dollar Index from both fundamental and technical standpoints, analyzing its latest movement and providing valuable insights for those navigating the trading signals, financial markets, and the stock market.

Understanding the U.S. Dollar Index

The U.S. Dollar Index is a weighted measurement of the dollar’s value against a basket of currencies, including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. By tracking the performance of the dollar against these major currencies, the USDX provides a comprehensive view of the dollar’s strength or weakness in the global foreign exchange (forex) market.

Fundamental Analysis

Fundamental analysis of the U.S. Dollar Index involves assessing the underlying economic factors that influence the dollar’s value. Key indicators and factors to consider include:

- Macroeconomic Data: Monitoring economic data releases such as GDP growth, inflation rates, employment figures, and central bank policies can provide insights into the health of the U.S. economy and its potential impact on the dollar.

- Interest Rates: Changes in interest rates set by the Federal Reserve can significantly impact the dollar’s value. Higher interest rates tend to attract foreign investors, increasing demand for the currency and strengthening its value.

- Geopolitical Factors: Political developments, trade disputes, and geopolitical tensions can create volatility in currency markets, affecting the dollar’s value. It is essential to monitor geopolitical events and their potential implications on the global economy.

Technical Analysis

Technical analysis of the U.S. Dollar Index involves studying historical price patterns, chart patterns, and technical indicators to identify trends and potential trading opportunities. Key aspects of technical analysis include:

- Price Patterns: Analyzing chart patterns such as support and resistance levels, trendlines, and chart formations can help identify key levels where the dollar may experience a reversal or continuation of its trend.

- Technical Indicators: Utilizing technical indicators like moving averages, relative strength index (RSI), and stochastic oscillators can provide additional insights into the dollar’s momentum, overbought or oversold conditions, and potential trend reversals.

- Market Sentiment: Monitoring market sentiment through tools like the Commitment of Traders (COT) report can offer valuable information on the positioning of traders in the futures market and the potential impact on the dollar’s direction.

Analyzing the Latest Movement of the U.S. Dollar Index

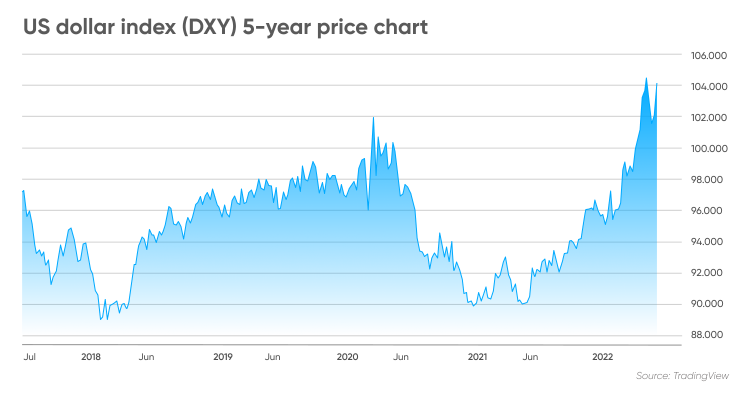

In recent months, the U.S. Dollar Index has experienced significant fluctuations driven by various factors. Here, we analyze the recent movement of the USDX, considering both fundamental and technical perspectives.

A. Fundamental Analysis of Recent Movement:

Recent developments in the U.S. economy, such as GDP growth, employment data, and interest rate changes, have influenced the dollar’s performance. Factors such as inflation expectations, fiscal policies, and trade dynamics have also contributed to the dollar’s movement.

B. Technical Analysis of Recent Movement:

Applying technical analysis tools to recent price charts of the U.S. Dollar Index reveals patterns, trends, and potential support and resistance levels. By combining key technical indicators with chart analysis, traders can gain insights into possible trading opportunities.

Implications for Trading Signals, Financial Markets, and the Stock Market:

The movement of the U.S. Dollar Index has implications across various sectors and markets, including:

A. Forex Trading: Traders involved in forex trading can utilize the U.S. Dollar Index as a key indicator to assess the dollar’s strength or weakness against major currencies. Understanding the USDX can help traders make informed decisions and generate trading signals in the forex market.

B. Financial Markets: The U.S. dollar’s performance has a significant impact on financial markets globally. Fluctuations in the USDX can influence the value of commodities, such as gold and oil, as well as impact stock market indices and bond yields.

C. Stock Market: The U.S. Dollar Index can indirectly affect the stock market, particularly for companies that rely heavily on exports or have significant international operations. A stronger dollar can impact profitability and competitiveness for these companies, potentially affecting stock prices.

Conclusion

Navigating the U.S. Dollar Index for Trading Success In conclusion, understanding the U.S. Dollar Index from both fundamental and technical perspectives is essential for traders and investors seeking to navigate the trading signals, financial markets, and the stock market. By analyzing the USDX’s latest movement, incorporating fundamental and technical analysis, and staying informed about economic factors, traders can make informed decisions and capitalize on potential trading opportunities in the dynamic world of forex and financial markets.

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. Trading and investing involve risk, and it is important to conduct thorough research and seek professional guidance before making any investment decisions.

Keywords: trading signal, financial market, stock market, dollar, forex