Introduction: Fed and interest rates

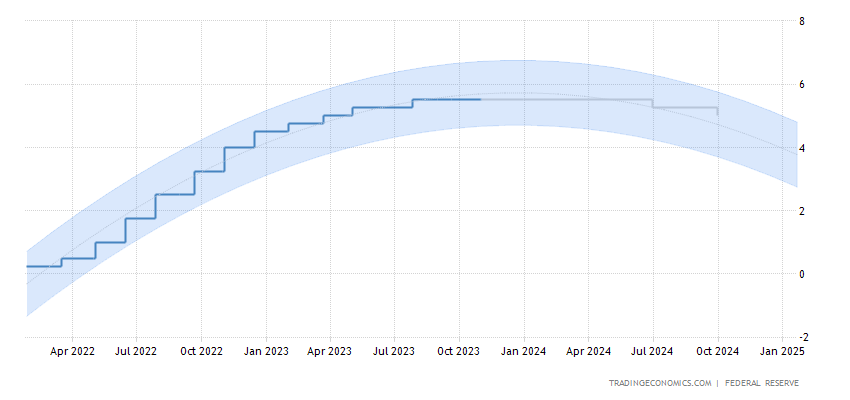

In November, the Federal Reserve held firm, maintaining the federal funds rate within the 5.25%-5.5% range for the second successive term. This deliberate action reveals the Fed’s nuanced approach, aiming to balance the critical objectives of taming inflation back to the 2% target without instigating excessive monetary tightening.

Policy Emphasis: Juggling Inflation and Monetary Tightening

Policymakers underlined their cautious stance, emphasizing a thorough assessment before further policy adjustments. This included evaluating the cumulative effects of prior rate hikes, considering time lags inherent in monetary policy’s impact on economic activity and inflation, and closely monitoring economic and financial market developments.

Powell’s Remarks: Revisiting Rate Projections and Future Actions

Chairman Powell, during the press conference, indicated a potential shift from the September dot-plot projections. The initial majority anticipation for a single rate hike this year might now be subject to alteration. Additionally, Powell clarified that rate cuts had not entered the discussion realm, reaffirming the Fed’s current focus on assessing the necessity for additional rate hikes.

The Fed’s Dilemma: Balancing Act and Monetary Policy Outlook

The Federal Open Market Committee (FOMC) faces a delicate balancing act amid evolving economic conditions. The central bank must navigate the complexities of controlling inflation without hampering economic growth. As market dynamics and economic indicators fluctuate, the Fed’s decision-making process becomes increasingly intricate.

Advice Amidst Uncertainty: Navigating the Interest Rate Landscape

For investors and financial stakeholders, navigating the Fed’s interest rate decisions requires a nuanced understanding of macroeconomic trends and the Federal Reserve’s strategic directives. Keeping a watchful eye on inflationary signals, employment data, and the Fed’s communication can aid in gauging potential policy shifts.

Conclusion: Fed and interest rates

The Federal Reserve’s resolute stance on interest rates underscores its commitment to recalibrating inflation while judiciously managing monetary policy. As economic landscapes evolve, stakeholders must remain agile, informed, and prepared to adapt strategies in response to the Fed’s evolving actions.