Introduction

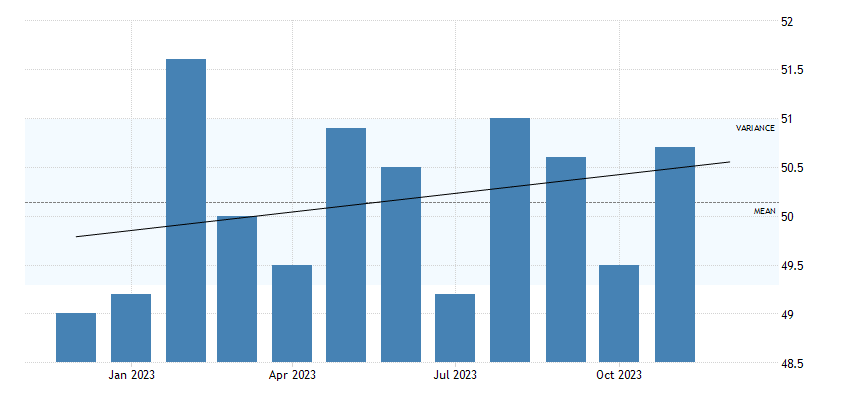

The China General Manufacturing PMI, a critical indicator of the nation’s economic health, surged to 50.7 in November 2023, surpassing October’s 49.5 and exceeding the projected 49.8. This unexpected upswing marked the highest reading since August, unveiling a promising trajectory for China’s manufacturing landscape. Notably, the upturn in both output and purchasing levels heralded a resurgence after concerted initiatives by Beijing to invigorate a previously lethargic economy.

Amidst this resurgence, new orders experienced a significant uptick, boasting the most substantial increase in four months, while the rate of job reduction showed signs of easing, instilling hope for stabilization in the employment sphere. Concurrently, supply chain performance depicted a marginal improvement for the second consecutive month, indicating a gradual but steady recovery.

Despite these positive trends, the data on prices reflected a subdued landscape with modestly escalating input costs, a pace notably slower than that of October. Concurrently, efforts to lure and secure sales restrained pricing capabilities, maintaining output charges at a largely unaltered level. This stability in prices signals both resilience and caution in the face of economic revival.

Dr. Wang Zhe, a senior economist at Caixin Insight Group, emphasized the ongoing macroeconomic recovery, stressing the need for policies aimed at establishing a robust foundation for sustained long-term growth and fostering enduring market confidence. The sentiment reached a four-month zenith, aligning with the positive outlook for the future of China’s manufacturing landscape.

Understanding the implications of the China General Manufacturing PMI surge is crucial for businesses and investors navigating the intricate economic environment. The sudden upturn in the manufacturing sector offers strategic opportunities for companies to capitalize on increased demand and improved market sentiment. For businesses, this could translate into reassessing supply chain strategies to align with the anticipated growth trajectory while staying vigilant of evolving pricing dynamics.

Investors should closely monitor this shift, recognizing the potential for growth and resilience within the Chinese manufacturing domain. A proactive approach to analyzing industry-specific trends, especially in sectors aligned with manufacturing, can facilitate informed investment decisions. Keeping abreast of policy changes and economic stimuli introduced by Beijing remains imperative for gauging the sustainability of this upward trajectory.

While the China General Manufacturing PMI presents a promising scenario, it’s crucial to remain cognizant of the underlying challenges and uncertainties. Factors such as global supply chain disruptions, geopolitical tensions, and evolving market conditions could impede the seamless continuation of this positive trend. Mitigating risks through diversified portfolios and adaptable business strategies will be instrumental in navigating potential fluctuations.

Conclusion

In conclusion, the resurgence of China’s General Manufacturing PMI reflects a pivotal turning point in the nation’s economic recovery. Businesses and investors must adopt a forward-thinking approach, leveraging the burgeoning opportunities while remaining attuned to potential challenges. By carefully assessing market dynamics and aligning strategies with evolving trends, stakeholders can position themselves advantageously amidst this transformative phase in China’s manufacturing landscape.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.