In the ever-evolving world of finance, everyday folks like you and me are always on the hunt for good investment opportunities. The recent maneuvers by some heavyweights in the banking sector – the Federal Reserve (Fed), the Bank of England (BoE), and the European Central Bank (ECB) – have certainly stirred up some questions about how we should manage our hard-earned money. With a noticeable shift away from strict monetary policies, this significant change has sent ripples across the global market.

Now, you might be wondering, what does all of this mean for regular folks like us who just want to make savvy investment decisions? Well, that’s the puzzle we’re going to dissect in this comprehensive analysis. We’ll dig deep into the recent interest rate decisions these central banks have made and how they’ve left an indelible mark on the European government bonds market.

The Fed’s Policy Shift:

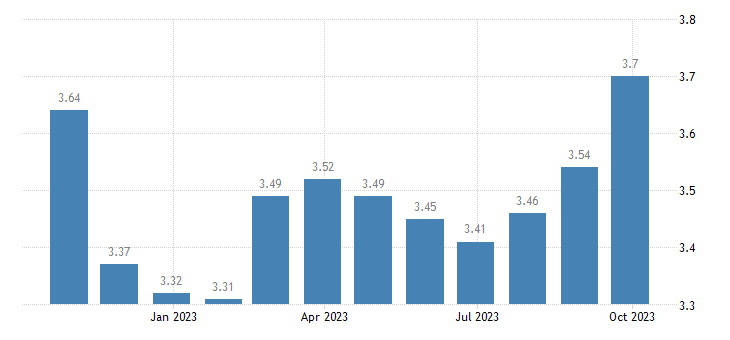

The Federal Reserve, a powerhouse in the realm of global economic influence, has made a decision of monumental proportions that has piqued the curiosity of investors across the globe. Straying significantly from its previous path of tightening, the Fed’s recent call on interest rates has ushered in a new chapter in the world of financial dynamics. The U.S. 10-year Treasury yield, often seen as a barometer of market sentiment, witnessed a striking decline of more than 0.25 percentage points (pp) in just a mere two days, settling at 4.67%. This substantial shift has left investors contemplating the ripple effects it might have on European government bonds and the wider global financial landscape.

European Markets:

As the Federal Reserve’s policy stance reverberates across the Atlantic, the European Central Bank and the Bank of England have also signaled their willingness to follow suit. The UK 10-year gilt, a key benchmark for European government bonds, saw a notable decrease of 0.15 pp, closing in at 4.35%, while the German equivalent slid by 0.05 pp, resting at 2.7%. These moves highlight the interconnectedness of the global financial system, emphasizing the importance of keeping a close eye on European government bonds, especially in the wake of these central bank policy shifts.

Implications for Investors:

The recent developments in the European government bonds market have created both opportunities and challenges for investors. As central banks step back from their tightening cycle, bond prices have surged, causing yields to fall. This, in turn, has sparked a wave of interest among investors seeking lower-risk assets in a climate of economic uncertainty. The declining yields on European government bonds, such as UK gilts and German bunds, have led to increased demand, driving prices higher. Investors who can navigate this landscape effectively may find attractive opportunities in these securities.

Diversification Strategies:

Diversification remains a cornerstone of sound investment strategies, and in the current economic climate, it takes on renewed significance. As investors reevaluate their portfolios, European government bonds offer a potential avenue for diversification. By allocating a portion of their investments to these bonds, investors can mitigate risk and enhance the overall resilience of their portfolios. With yields on the U.S. 10-year Treasury declining, European government bonds may provide a compelling alternative, offering stability and income potential.

Mitigating Risks:

While the prospect of investing in European government bonds may appear enticing, it is crucial to approach this market with caution and a comprehensive understanding of the risks involved. Interest rate fluctuations, currency risk, and economic uncertainties in the Eurozone are factors that investors should consider. Diversification, through a combination of different maturities and issuers, can help mitigate some of these risks. Furthermore, active management of bond portfolios can provide investors with greater control over their exposure to government bonds.

In the world of finance, staying informed is essential, especially when it comes to European government bonds. Keeping a close watch on central bank decisions and their subsequent impact on bond markets is imperative for investors seeking stability and returns. In this era of shifting monetary policies, understanding the dynamics of the bonds has become an integral part of any comprehensive investment strategy.

Conclusion:

In this analysis, we have explored the seismic shifts in the European government bonds market, driven by recent interest rate decisions from key central banks. The Fed, the BoE, and the ECB have all signaled a departure from their tightening cycles, sending yields on European government bonds on a roller-coaster ride. Investors must be proactive in navigating these tumultuous waters, employing diversification strategies and risk mitigation techniques. As the financial world adapts to these changes, staying informed and engaged with European government bonds is paramount for investors looking to make the most of these evolving opportunities. In a dynamic financial landscape, knowledge and adaptability are the keys to success.