Introduction

Australia’s trade surplus, a crucial barometer of the nation’s economic well-being, encountered a formidable test in the tumultuous September of 2023. With the globe’s watchful eye trained on these statistics, it becomes unmistakably clear that the panorama of international commerce is undergoing a profound transformation. In this meticulous examination, we embark on an expedition through the labyrinthine intricacies of Australia’s trade equilibrium, proffering sagacious counsel and profound insights. In the midst of contemporary fiscal vagaries, acquainting oneself with the ever-shifting tides of Australia’s trade surplus assumes paramount importance for investors, policymakers, and aficionados of economic intricacies.

The Decline in Trade Surplus

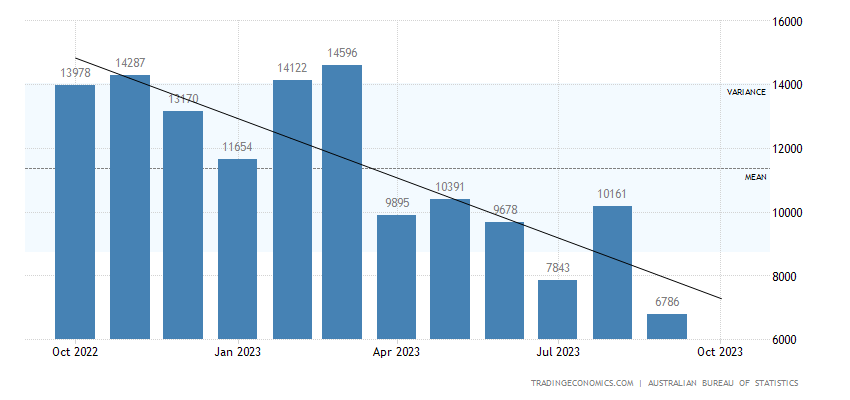

In September 2023, Australia’s trade surplus on goods dwindled to a 30-month low of AUD 6.79 billion, marking a significant departure from August’s upwardly revised AUD 10.16 billion. This tumble not only fell below market forecasts, with an expected AUD 9.4 billion gain but also raised concerns about the nation’s trade resilience. Exports bore the brunt, declining 1.4% to AUD 45.62 billion, primarily influenced by the fall in non-monetary gold shipments. In stark contrast, imports soared by 7.5% to a record high of AUD 38.84 billion, predominantly driven by industrial transport equipment.

Trade Surplus and International Services

Notably, the availability of monthly international trade in services statistics data has been curtailed in this monthly publication. This information is now reserved for quarterly releases in the balance of payments and international services data. This shift in data availability reflects the evolving nature of the trade landscape and its impact on Australia’s overall trade balance.

Challenges and Opportunities

Australia’s trade balance is no longer immune to the volatility and uncertainties in the global market. While the decline in the trade surplus may raise concerns, it also unveils new opportunities. The trade deficit in goods is a call for diversified export strategies. Navigating these challenges requires a prudent approach, and policymakers must keep a watchful eye on global economic dynamics.

Impact on Financial Markets

The fluctuations in Australia’s trade surplus have repercussions beyond the realm of economics. Investors and traders alike closely monitor these figures as they have the potential to influence currency values, interest rates, and stock market performance. The recent decline in the trade surplus may lead to a depreciation of the Australian dollar, affecting the profitability of foreign investments. Diversification of investment portfolios becomes imperative to mitigate risks.

Policy Measures

In response to the shifting trade landscape, policymakers need to adopt a proactive stance. Diversifying export markets, investing in innovation and technology, and fostering trade agreements with strategic partners can be instrumental in boosting Australia’s trade balance. Moreover, promoting economic resilience through domestic initiatives is equally important.

A Look Ahead

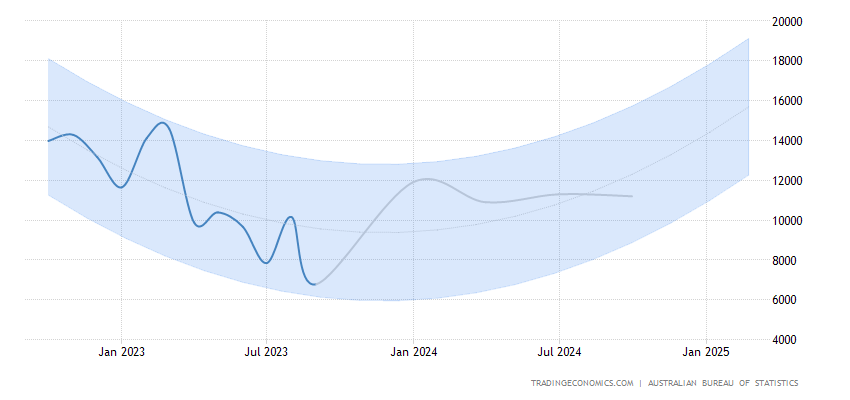

The future of Australia’s trade balance stands at the crossroads of risks and opportunities. As we chart our course through these tumultuous economic waters, it’s crucial to recognize the ever-shifting currents of global trade. The stark reality of Australia’s trade surplus in September 2023 serves as an unmistakable wake-up call, compelling us to respond to the evolving tides of the international trade landscape. This is not just a matter of numbers; it’s a mirror reflecting a nation’s economic resilience and its ability to adapt and thrive in an ever-changing world.

Conclusion: Australia’s trade

Australia’s trade surplus, although declining in September 2023, is not just a number on a balance sheet; it is a reflection of the nation’s ability to weather the storm of global economic fluctuations. In this intricate web of trade dynamics, opportunities abound, but so do challenges. As we tread into the future, it’s essential to remain vigilant, adapt to the evolving landscape, and craft policies that bolster economic resilience. By doing so, Australia can continue to thrive in the world of international trade.

One thought on “Australia’s Trade Surplus: What It Means for Investors and Economists”