Introduction

In the complex realm of modern finance, the Federal Reserve wields significant power, shaping the course of the U.S. economy like the conductor of an intricate symphony. For the past two decades, the folks at the Fed have been carefully tending to what’s known as the federal funds rate – it’s like the volume control for the economy, hovering in the range of 5.25% to 5.5%.

This isn’t just some random choice; it’s all part of their grand plan. You see, the Fed has a dual mandate, and they take it quite seriously. One part of their job is to prevent inflation from running wild – that means keeping prices in check. The other part is about boosting economic growth and ensuring prosperity for all.

So, let’s roll up our sleeves and dive into the nitty-gritty of this federal funds rate. How does it impact ordinary folks like you and me, and what’s the latest buzz on what the Fed’s decision-makers are cooking up in their secret policy lab?

The Federal Funds Rate in Historical Context

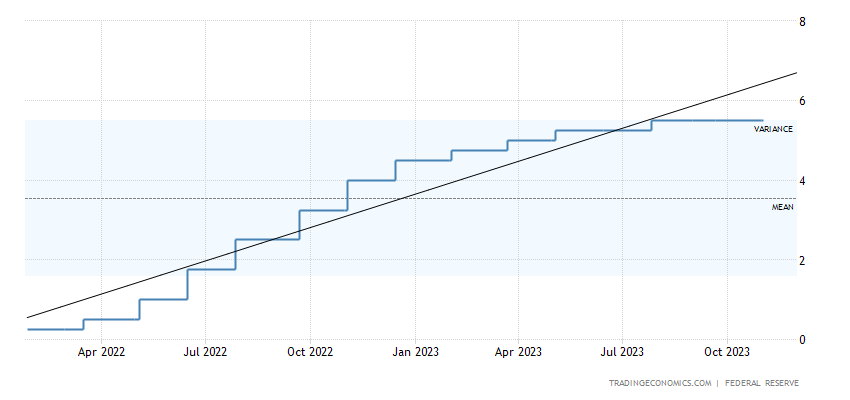

To truly appreciate the weight of the current federal funds rate, let’s take a little trip down memory lane and see how it’s evolved over time. The federal funds rate, in plain English, is the interest rate at which banks loan money to each other overnight. It might sound a bit wonky, but it’s a powerful tool that the Federal Reserve uses to shape the economic landscape.

As we close in on the end of November, this rate is standing tall at a 22-year high, sitting within the range of 5.25% to 5.5%. That’s no small feat, and it’s a big deal for the entire financial world. You can bet your bottom dollar that this number packs a hefty punch when it comes to the overall financial ecosystem.

Federal Funds Rate and Inflation

One of the primary considerations for the Federal Reserve in setting the federal funds rate is its dual mandate, which involves managing inflation and fostering economic growth. With an inflation target of 2%, policymakers have maintained a hawkish stance. However, as we navigate the economic terrain, the central bank faces a delicate balancing act. The cumulative effects of previous interest rate hikes, the time lags associated with monetary policy’s influence on economic activity and inflation, and the ever-changing dynamics of the economy and financial markets come into play.

Federal Reserve’s Policy Deliberations

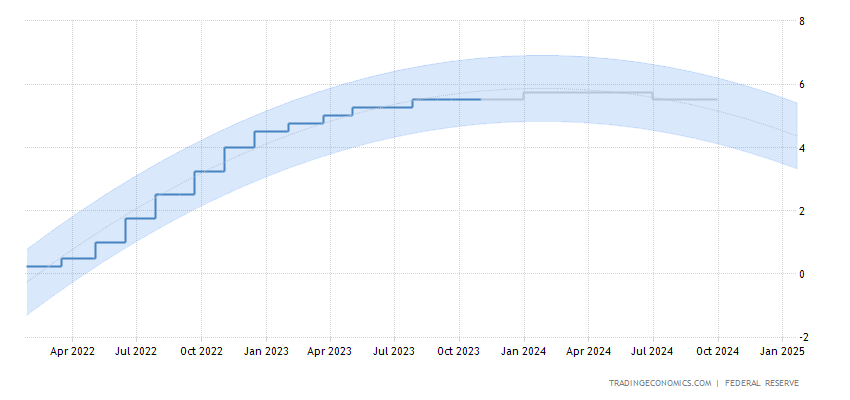

Policymakers are keenly aware that they must consider a host of variables when contemplating any further policy tightening. They remain vigilant regarding the potential repercussions of previous interest rate hikes. The impacts of these adjustments are not immediate; instead, they ripple through the economy over time, influencing consumer spending, business investment, and lending practices. These time lags necessitate a cautious approach, whereby the Federal Reserve must closely monitor their decisions and the ensuing consequences.

Chairman Powell’s Pronouncements

Federal Reserve Chairman Jerome Powell, a heavyweight in the financial world, has been taking center stage in these crucial discussions. In a recent press conference, he dropped some hints about the September dot-plot, a kind of roadmap that suggests what most of the big players at the Fed think about interest rates. It hinted at the likelihood of another rate hike this year. But Chairman Powell basically said, “Hold on a minute.” He pointed out that the economic picture is always changing, and flexibility in decision-making is key.

However, he made it crystal clear that the Federal Open Market Committee (FOMC) hadn’t started chatting about cutting rates just yet. What’s keeping them up at night is whether they need to crank those rates up some more to achieve their goals. That’s the big question on their minds, and Powell wants us all to know it.

The Federal Funds Rate’s Impact on Financial Markets

The federal funds rate, which is like the interest rate lever controlled by the Federal Reserve, sends ripples through the financial markets, touching all sorts of investment tools and tactics. When the Fed cranks up this rate, it gets pricier for big players to borrow money on a short-term basis, and this sends shockwaves throughout the interest rate landscape.

One area that really feels the heat is the bond market. Bonds are like the delicate flowers of the financial world, and they’re super sensitive to changes in the federal funds rate. When the rate goes up, the prices of existing bonds tend to go down. This can make it quite a challenge for investors who are looking to make a decent return on their fixed-income investments. It’s like a complex dance where every step matters.

Economic Indicators and the Federal Funds Rate

In addition to examining financial markets, we must consider how the federal funds rate interacts with key economic indicators. It has a profound influence on unemployment levels, GDP growth, and consumer sentiment. For instance, a more accommodative stance on interest rates can stimulate borrowing and spending, which, in turn, can boost economic activity and lower unemployment. On the flip side, a hawkish approach can cool down an overheating economy but also have the potential to stifle economic growth.

Strategies for Investors

Given the critical role of the federal funds rate in the financial landscape, investors should closely monitor its movements and implications. In times of rising rates, it may be prudent to reevaluate portfolio allocations. Fixed-income investors may seek shorter-duration bonds to mitigate interest rate risk, while equity investors may consider sectors that historically perform well in such environments. Diversification, a fundamental principle of investing, becomes ever more crucial during periods of uncertainty regarding the direction of monetary policy.

The International Dimension

The impact of the federal funds rate is not confined solely to the United States. Given the interconnected nature of global financial markets, changes in U.S. interest rates can send ripples across the world. International investors, central banks, and businesses all take note of the Federal Reserve’s policy decisions, as they can affect exchange rates, trade balances, and capital flows. Thus, the federal funds rate is a vital factor in the intricate web of international finance.

The Path Forward

In the intricate world of finance and economics, it’s crystal clear that the federal funds rate is a linchpin of monetary policy. The Federal Reserve’s got a double mission – keeping inflation in check and firing up economic growth. This mission has led them to stick with a high federal funds rate lately. Their decisions aren’t made on a whim; they carefully weigh the impact of previous rate hikes, consider the time it takes for policy changes to work their magic, and stay on their toes to adapt to the ever-changing economic and financial terrain. It’s a big deal, to say the least.

In a nutshell, the Federal Reserve’s handling of the federal funds rate is like a high-wire act, walking a fine line. Their role in steering the economy and financial markets is huge. Whether you’re an investor, a policy wonk, or just someone keeping an eye on things, grasping the ins and outs of the federal funds rate and its broader effects is a must in today’s financial world. And you can bet your bottom dollar that the path of this rate will continue to be a hot topic as we navigate through the ever-shifting economic landscape.

One thought on “Federal Funds Rate: The Cornerstone of Monetary Policy”