Introduction:

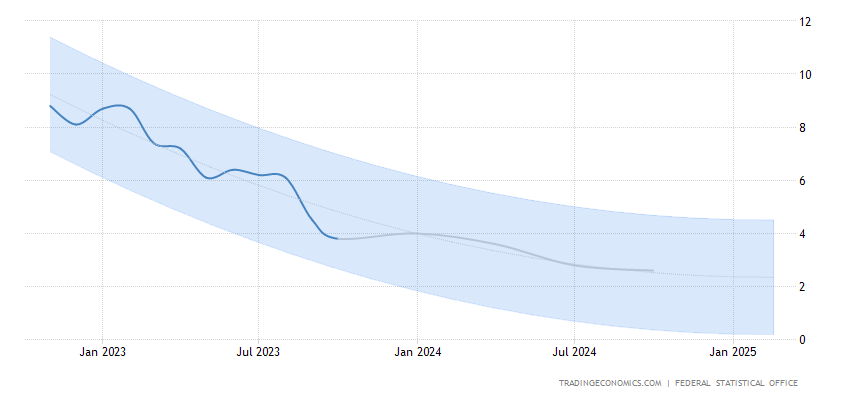

In October 2023, the economic landscape in Germany witnessed a notable shift as German consumer price inflation experienced a significant downturn. Falling to 3.8% year-on-year, this data marked a sharp decline from the previous month’s 4.5%. Notably, this figure came in slightly below the market consensus of 4%, reflecting a preliminary estimate. This revelation represents the lowest level of inflation in the nation since August 2021, with food inflation easing to its lowest level since February 2022 at 6.1%, a notable drop from 7.5% in September. Moreover, energy prices decreased for the first time since January 2021, registering at -3.2% compared to the previous month’s 1.0%. In the realm of services, inflation remained relatively unchanged at 3.9%, a slight drop from the previous month’s 4.0%. Core inflation, which excludes volatile items like food and energy, also dipped to 4.3% in October, down from September’s 4.6%, hitting its lowest point since August 2022. On a monthly basis, consumer prices remained unchanged in October, following a 0.3% increase in September and narrowly missing the market consensus of 0.2%.

Interpreting the Impact: Decreased German Consumer Price Inflation

German consumer price inflation is a critical economic indicator, influencing investment strategies, consumer behavior, and the broader financial markets. In October 2023, the substantial drop to 3.8% raised eyebrows and gave investors and economists much to ponder. This abrupt shift underscores the dynamic nature of the German economy and its sensitivity to various internal and external factors.

The downward trend in inflation rates presents both challenges and opportunities for investors and policymakers. As German consumers enjoy some respite from soaring prices, their purchasing power is bolstered. However, this may also impact investment strategies, and it’s essential to stay abreast of these developments for informed decision-making.

Food Inflation: A Key Player in the Inflation Decline

One noteworthy factor contributing to the decrease in inflation is the significant drop in food prices. Food inflation, which stood at 6.1% in October, is the lowest it has been since February 2022. This reduction in food prices can be attributed to several factors, including a better agricultural output, decreased supply chain disruptions, and potentially improved weather conditions.

For investors, this decline in food inflation has the potential to open up opportunities in the agricultural sector. As food prices stabilize, it might be an ideal time to consider investments in this market. However, it’s vital to keep an eye on ongoing developments, as factors like global weather patterns and geopolitical events can influence food prices.

Energy Prices Take a Tumble: Implications and Considerations

Equally significant is the decrease in energy prices, which registered at -3.2% in October, marking the first decline since January 2021. The energy sector is highly sensitive to global events, such as geopolitical tensions, production cuts, and shifts in energy policies. These factors can influence energy prices significantly.

This drop in energy prices is a boon for consumers, as it reduces their energy bills and contributes to the overall reduction in the cost of living. However, it can have implications for investments in the energy sector. Investors should closely monitor global energy dynamics and consider how these fluctuations might impact their portfolios.

Steady as She Goes: Services Inflation Amidst the Decline

Despite the overall decrease in inflation, services inflation remained relatively stable at 3.9% in October, only slightly lower than the previous month’s 4.0%. Services encompass a wide range of sectors, including healthcare, education, and leisure. Understanding the dynamics of services inflation is crucial for both consumers and investors.

Investors should be cautious in interpreting this data. While services inflation remained steady, the overall economic environment can influence specific service sectors. Healthcare costs, for example, may continue to rise due to ongoing challenges in the healthcare industry. Education costs might be influenced by policy changes. As such, investors need to consider the broader economic context when evaluating their portfolios.

Unpacking Core Inflation: A Window into the Economy

Core inflation, which excludes volatile items like food and energy, decreased to 4.3% in October, down from September’s 4.6%. This metric is vital for understanding the underlying inflation trend in the German economy. While core inflation tends to be more stable, it can still experience fluctuations.

Investors often rely on core inflation to make long-term investment decisions, as it provides a clearer picture of the sustained inflation rate. The recent decrease in core inflation indicates a potential shift in the economy, which should be taken into account when constructing investment portfolios.

Monthly Price Movements: Short-Term Insights and Trading Strategies

On a monthly basis, consumer prices remained unchanged in October, following a 0.3% increase in September and narrowly missing the market consensus of 0.2%. This observation underscores the importance of closely monitoring short-term price movements, as they can provide insight into consumer sentiment and market expectations.

Investors should pay attention to monthly price changes, as they can influence trading strategies. A stable month, such as October, may indicate market equilibrium, while unexpected shifts can lead to trading opportunities. Staying informed about these fluctuations is essential for investment success.

Conclusion: German consumer price inflation

The decline in German consumer price inflation in October 2023 signifies a shifting economic landscape with implications for consumers and investors alike. The decrease in food and energy prices, alongside stable services inflation, has reshaped the inflationary environment. Core inflation and monthly price movements also merit careful consideration.

To navigate these dynamics successfully, investors and policymakers must remain vigilant and adaptable. While lower inflation may benefit consumers, it necessitates a reevaluation of investment strategies. Staying informed and monitoring global factors that impact the German economy is essential for making well-informed financial decisions in this evolving economic landscape. German consumer price inflation is indeed a crucial metric to watch closely in the coming months.