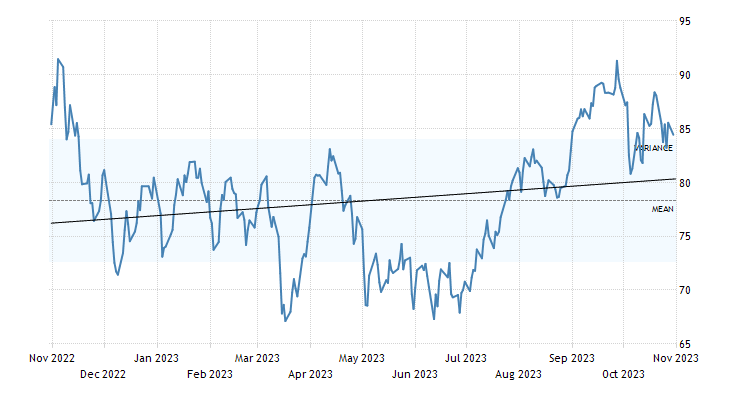

In the volatile world of commodities and financial markets, WTI crude futures recently made headlines as they dipped below the $85 per barrel mark on a fateful Monday. This abrupt shift in the oil market’s equilibrium came as investors adopted a more cautious stance, acutely aware of the impending high-stakes events on the economic horizon.

The week in question promised to be nothing short of a rollercoaster ride, marked by two pivotal events. First, the imminent interest rate decision by the US Federal Reserve hung in the balance, and second, the release of manufacturing activity data from China was eagerly anticipated. As financial analysts, we are acutely aware that these events hold the potential to reshape the global economic landscape.

Of paramount concern for market experts were the probabilities surrounding a looming economic slowdown in the United States and the potential indicators of economic stabilization in China. As two of the world’s largest oil consumers, these economic giants are known to sway oil prices with their economic health. A subtle shift in one could send shockwaves through the oil markets.

Surprisingly, the WTI crude prices displayed remarkable resilience despite the backdrop of escalating tensions in the Israel-Hamas conflict. The ground invasion of Israeli forces in the Gaza Strip was, to some extent, anticipated, which provided a semblance of stability in the oil markets. However, the real story lay in the market’s edge, fringed with apprehensions of a broader conflict erupting in the Middle East, a scenario that could spell disaster for global oil supplies.

In the labyrinthine world of financial markets, the WTI crude signals have long served as a compass, guiding investors and experts alike. These signals are far from being mere fluctuations; they are key indicators of the world’s economic health, offering crucial insights that can shape investment strategies and influence the decisions of major stakeholders.

With the ever-present fear of a US economic slowdown, markets were inextricably tied to the decision-making process of the US Federal Reserve. Their interest rate decision was the linchpin upon which market sentiments hinged. A rise in rates would invariably dampen economic activity, potentially impacting oil demand, and thus WTI prices. Conversely, a decision to maintain or lower rates could stimulate economic growth, spelling good news for oil prices.

On the other side of the globe, the manufacturing activity data from China was another pivotal piece of the puzzle. China’s economic strength and stability have positioned it as a bellwether for global markets. If the data hinted at further economic stabilization, it could offset concerns about the US economic slowdown and provide a welcome boost to WTI crude prices.

As the financial world kept a watchful eye on these developments, the Middle East threw a wildcard into the mix. The Israel-Hamas conflict, with its potential to disrupt oil supplies, was an unpredictable factor that intensified market anxieties. Any sign of escalation in this volatile region had the potential to send shockwaves through global oil markets.

Navigating the murky waters of the financial world, investors were acutely aware that the intersection of these factors would require nimble decision-making and a deep understanding of the forces at play. To successfully ride the waves of WTI crude signals, it was crucial to stay informed and adaptable in response to changing circumstances.

In conclusion, the WTI crude signals represent far more than just numbers on a screen; they are the pulse of the global economy. The recent dip below $85 per barrel underscored the market’s cautious optimism in the face of economic uncertainties and geopolitical tensions. To thrive in this complex landscape, investors and analysts must remain vigilant, staying abreast of the latest developments, and adjusting their strategies to harness the full potential of WTI crude signals.