Introduction:

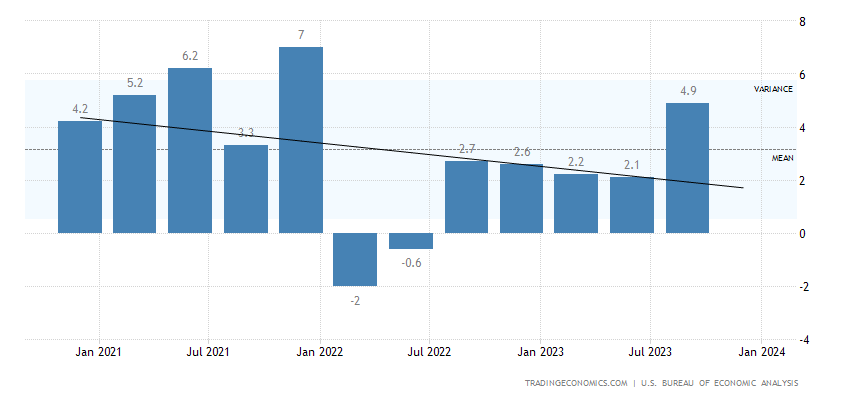

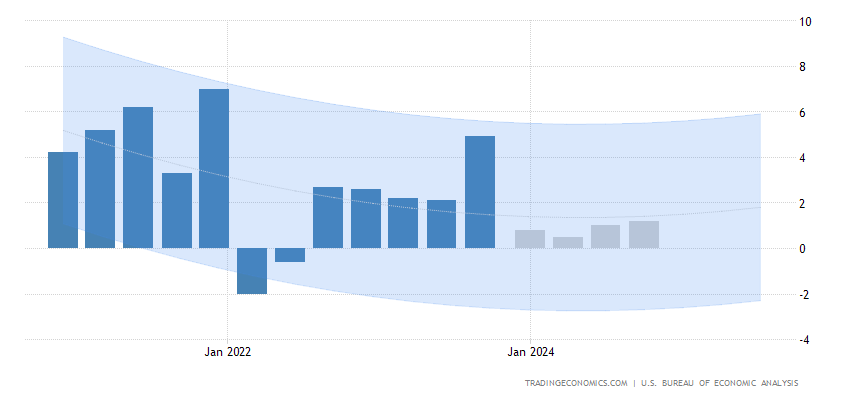

The American economic landscape is ever-evolving, often proving itself to be a resilient force amidst the unpredictabilities of the global financial sphere. In the third quarter of 2023, the United States bore witness to a remarkable upswing, with its GDP expanding at an annualized rate of 4.9%. This surge, the most significant since the end of 2021, surpassed market expectations of 4.3% and marked a stark contrast to the 2.1% expansion witnessed in the second quarter. This essay delves into the intricacies of this exceptional economic growth, its underlying components, and the potential ramifications it may hold for discerning investors seeking SP500 stock signals.

Consumer Spending:

Consumer spending, the bedrock of the American economy, surged by 4% in the third quarter of 2023, echoing the vigor not seen since the conclusion of 2021. This robust performance stands in stark contrast to the tepid 0.8% increase recorded in the preceding quarter. A multifaceted analysis of this surge reveals that it was primarily driven by increased consumption in various sectors, including housing and utilities, healthcare, financial services and insurance, food services and accommodations, and nondurable goods – prescription drugs taking the lead. Furthermore, recreational goods and vehicles contributed to this remarkable upswing.

The implications of this surge in consumer spending are profound. The consumer-driven engine of the US economy is not only firing on all cylinders but also resonating with a sense of renewed optimism. For investors seeking SP500 stock signals, the surge in consumer spending signals potential opportunities in sectors closely tied to these expenditures, such as the healthcare and housing industries.

Exports and Imports:

The export sector saw a resurgence in the third quarter, with a remarkable 6.2% uptick following a disheartening 9.3% decline in the second quarter. This turnaround, while significant, is not without implications, particularly in the context of the US-China trade relations and global economic dynamics. The United States’ ability to regain ground in the export sector could hold valuable cues for investors.

In contrast, the uptick in imports, which rose by 5.7% in the third quarter, is indicative of the resurgence in domestic demand. As the American economy continues to expand, the thirst for imported goods has swelled. Investors monitoring SP500 stock signals should remain watchful of industries intertwined with imports, as their performance could be tightly coupled with the nation’s economic trajectory.

Private Inventories and Residential Investment:

The third quarter of 2023 brought a noteworthy development in the form of private inventories, which contributed 1.32 percentage points to the overall economic growth. This upswing represents the first gain in three quarters, underlining the efficiency of inventory management across industries. While often overlooked, the intricacies of private inventories can be a crucial factor for investors.

Meanwhile, the residential investment sector demonstrated a remarkable resurgence, expanding by 3.9%, a stark contrast to the 2.2% contraction seen in the preceding quarter. This signals the first time in nearly two years that residential investment has shown such resilience. With the housing market back in action, investors eyeing SP500 stock signals may find opportunities in industries tied to real estate and housing, such as construction and mortgage lending.

Government Spending and Nonresidential Investment:

Government spending, a pivotal factor in economic dynamics, accelerated at a faster pace in the third quarter of 2023, increasing by 4.6% as compared to 3.3% in the previous quarter. This growth is indicative of the government’s commitment to supporting the economy in the face of uncertainties and challenges. Investors should monitor how this trend evolves, as it can have a ripple effect on various sectors, particularly in healthcare, infrastructure, and defense, and subsequently influence SP500 stock signals.

However, nonresidential investment displayed a contrary trend, contracting by 0.1% in the third quarter after a robust 7.4% growth in the second quarter. This contraction was primarily due to a 3.8% fall in equipment investment and a notable slowdown in structures. The performance of the nonresidential sector bears significance, as it may offer cues to investors on the resilience of various industries and potential entry points for strategic investments.

Conclusion:

The economic performance of the United States in the third quarter of 2023 stands as a testament to its resilience and adaptability in a world of economic uncertainties. While challenges persist, including those related to global trade dynamics and supply chain disruptions, the remarkable growth across various sectors provides valuable insights for investors seeking SP500 stock signals.

As we navigate these uncharted waters, it is imperative for investors to stay informed, remain adaptable, and conduct thorough research. The current economic landscape is dynamic, and opportunities are ripe for those who pay heed to the nuanced shifts and trends within the market. The spectacular performance in the third quarter serves as a promising harbinger of the nation’s economic health, and for those who are vigilant, it may hold the key to unlocking rewarding investment avenues.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.