The stage was set at the September 2023 Federal Open Market Committee (FOMC) meeting as the guardians of the U.S. economy convened to discuss the critical issue of the federal funds rate. This gathering of financial maestros, tasked with steering the nation through tumultuous economic waters, bore witness to a diversity of views on the appropriate path forward. SP500 stock signal

The Fed’s Monetary Crossroads

As the meeting minutes divulged, the majority of Fed policymakers espoused the view that a further increase in the federal funds rate was looming on the horizon. These hawkish voices rang out with confidence, believing that such a measure would be essential. Conversely, some within the committee held their ground, arguing that no further rate hikes were warranted. The divergence of opinion among these financial virtuosos cast a spotlight on the uncertainty of the economic landscape.

The Unifying Force of Inflation

Amidst this intellectual tug of war, there was a point of harmony among the committee members. The FOMC, a group often riven by dissent, found common ground in their unanimous agreement that a restrictive monetary policy should persist until inflation descended to the cherished 2% level. This resolve to tackle inflation head-on underscored the weighty task at hand, aligning the monetary orchestra to a common rhythm.

The Great Unknown: Economic Uncertainty

While the FOMC painted a picture of converging goals regarding inflation, it was evident that the path to achieving them remained shrouded in uncertainty. Economic pundits and policymakers alike awaited the unveiling of forthcoming economic data like fortune tellers reading tea leaves. These data, they hoped, would bring clarity to the enigmatic dance of disinflation and labor market dynamics.

As the future trajectory of the economy materialized like a mirage in the desert, uncertainty loomed like an omnipresent specter. Many wise sages within the FOMC camp cautioned against jumping to conclusions, citing the volatility of economic data and the potential for revisions. The elusive nature of the neutral policy rate only added to the complexity of the situation, further buttressing the argument for a cautious approach in determining the extent of additional policy tightening.

The Interest Rate Quandary

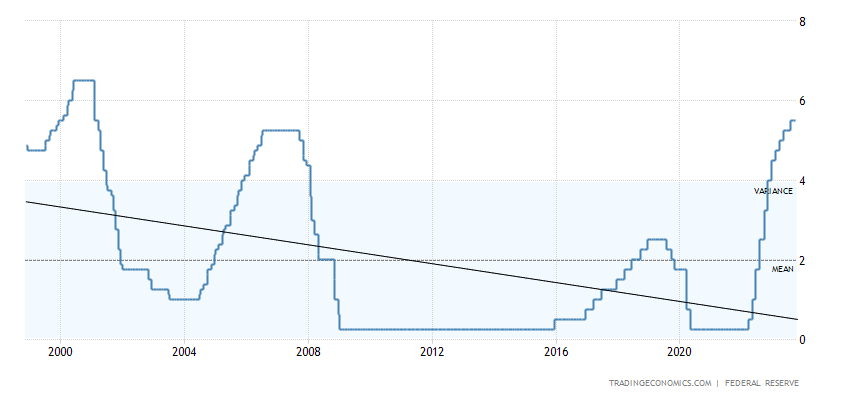

September 2023 saw the Federal Reserve maintaining its target range for the federal funds rate at a staggering 5.25% – 5.5%. This marked the highest level in over two decades, a testament to the severity of the challenges facing the U.S. economy. As the specter of further rate increases lingered, market participants awaited the SP500 stock signal, yearning for clues on how these monetary maneuvers might influence the stock market.

SP500 Stock Signal: A Ray of Clarity

The SP500 stock signal, a beacon of hope in these tempestuous financial waters, took center stage at the September FOMC meeting. As market participants clung to every word and gesture, they sought to decipher the Fed’s intentions regarding its influence on the stock market. With the omnipresent allure of the stock market’s performance, the Fed held a considerable sway in guiding the direction of this vital economic indicator.

Expert Advice: Navigating the Uncertainty

In this climate of uncertainty, where the siren call of the stock market echoes through the financial corridors, prudence and knowledge are paramount. For investors and traders alike, it is crucial to remain vigilant, keeping a close watch on the shifting sands of the monetary landscape. The SP500 stock signal serves as a vital compass, offering insights into the potential ebbs and flows of the market. Diversifying one’s portfolio, staying informed about Fed policy changes, and seeking advice from financial experts can all contribute to making informed investment decisions in these tumultuous times.

Transitioning Through the Economic Maze

In this intricate financial tapestry, transition words serve as guiding stars, illuminating the path through a maze of economic jargon and policy discourse. They help us move seamlessly from one idea to the next, stitching together a cohesive narrative that weaves through the complexities of the September 2023 FOMC meeting and the enigmatic SP500 stock signal.

Balancing Act: The Fed’s Delicate Choreography

Within the hallowed halls of the FOMC, a delicate choreography played out. The majority of members favored further rate hikes, while a vocal minority argued for restraint. This discord underscored the intricate balance the Fed must strike as it navigates the economic high-wire, juggling the demands of inflation, labor markets, and economic stability.

Unanimity Amidst Discord

However, despite the cacophony of voices within the committee, a moment of unity emerged. The FOMC found solace in the agreement that restrictive policies must persist until inflation reaches 2%. This shared objective became a lodestar, guiding the ship through the choppy waters of economic uncertainty.

Economic Crystal Ball: Data as the Oracle

As the meeting minutes revealed, the crystal ball of economic forecasting remained cloudy. Participants acknowledged the enigmatic nature of the future, noting the volatility of data and the potential for revisions. It was clear that the path ahead would be marked by uncertainty, a terrain where caution should be exercised.

Financial Markets: The Fed’s Puppet Strings

The Federal Reserve’s influence on the stock market was palpable at the September 2023 meeting. As investors clamored for the elusive SP500 stock signal, the Fed’s policy decisions held the power to sway the tides of the market. The stock market’s performance became intrinsically tied to the Fed’s moves, making it an indispensable metric for investors.

In Conclusion: SP500 stock signal

In the ever-evolving financial landscape, the September 2023 FOMC meeting painted a picture of uncertainty and divergence of opinion. The SP500 stock signal emerged as a key player, its fluctuations closely linked to the Fed’s monetary policy decisions. As a prudent investor, one must keep a watchful eye on the SP500 stock signal, stay informed about the Fed’s moves, and seek advice from experts who can provide clarity in these uncertain times. In this economic crossroads, vigilance and knowledge are your allies, guiding you through the maze of economic volatility.

One thought on “Navigating the Economic Crossroads: The September 2023 FOMC Meeting and the SP500 Stock Signal”