Introduction: A Shifting Economic Landscape

In the intricate tapestry of global economics, few threads are as crucial as inflation. The rise and fall of consumer prices can shape economies, influence central bank policies, and sway financial markets. Germany, a powerhouse in the European Union, stands as a barometer of economic health, and its recent consumer price inflation trends in September 2023 have garnered significant attention. In this comprehensive exploration, we will dissect the factors behind Germany’s shifting inflation landscape, shedding light on what this means for investors seeking the elusive “Dax stock signal”

A Retreat in Inflation: The Numbers Unveiled

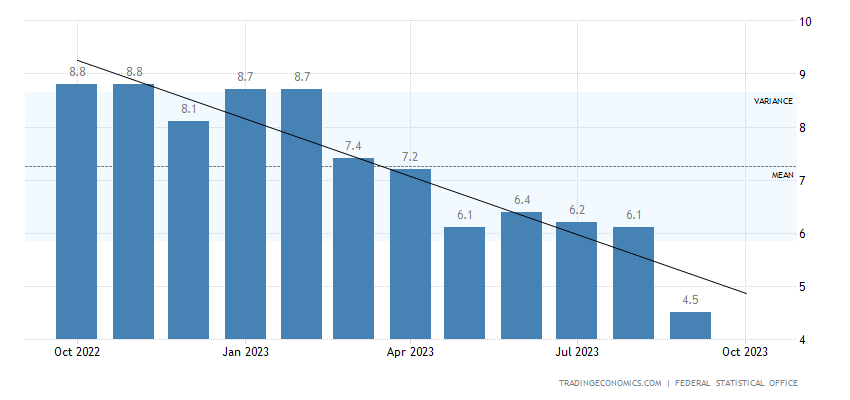

The preliminary estimates for September 2023 reveal a noteworthy development in Germany’s consumer price inflation. Year-on-year, the inflation rate dropped to 4.5%, marking a substantial decline from the previous month’s 6.1%. This deflationary trajectory, while slightly below the market expectation of 4.6%, signifies a significant shift in the nation’s economic dynamics. Notably, this is the lowest inflation rate since the outbreak of the war in Ukraine in February 2022, a period marked by economic turbulence and uncertainty.

Services and Goods: A Dual Slowdown

Delving deeper into the data, we uncover a dual deceleration in the inflation of both services and goods. Service prices, often regarded as a key indicator of economic health, saw a more moderate increase of 4.0% in September, down from 5.1% in August. This moderation can be attributed, in part, to a base effect stemming from the discontinuation of the so-called 9-euro ticket in September 2022. This shift in consumer dynamics had a palpable impact on service price dynamics, reflecting a temporary adjustment in the market.

Additionally, the realm of goods witnessed a comparable slowdown, with inflation easing from 7.1% in August to 5.0% in September. This deceleration was driven by a collective slowdown in both food prices, which registered 7.5% in September compared to 9.0% in August, and energy costs, which exhibited a remarkable downturn from 8.3% to 1.0%. The latter’s decline, in particular, can be attributed to a base effect, with September 2022 marking the conclusion of a fuel discount, resulting in an inflated comparative figure.

The Core Rate: A Deeper Dive

While the headline figures capture attention, it’s imperative to scrutinize the core rate, which excludes the volatile components of food and energy. In September 2023, this critical metric fell to a one-year low of 4.6%. This decline in the core rate, which provides a more stable perspective on inflation trends, underscores the multifaceted nature of Germany’s economic environment.

Conclusion: Navigating Economic Uncertainties

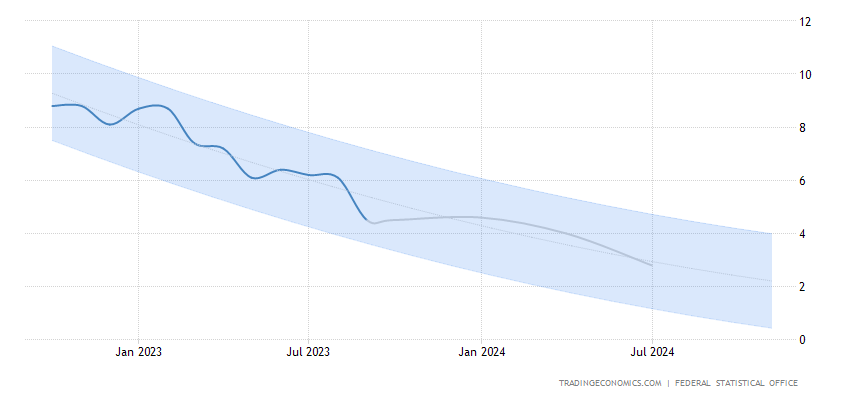

Germany’s consumer price inflation trends in September 2023 paint a complex picture of economic dynamics. The retreat in inflation, influenced by a blend of base effects and shifting consumer behaviors, raises questions about the trajectory of the nation’s economic recovery. For investors, particularly those attuned to the “Dax stock signal,” this calls for a nuanced approach.

The interplay of inflation, monetary policies, and market dynamics is an intricate dance that requires careful observation. As Germany navigates these economic uncertainties, investors must remain vigilant and adaptable. The shifting sands of inflation can influence investment strategies and market sentiments, making it paramount to stay informed and agile in the ever-evolving economic landscape.

2 thoughts on “Navigating Dax stock signal: Consumer Price Inflation Trends in 2023”