Introduction:

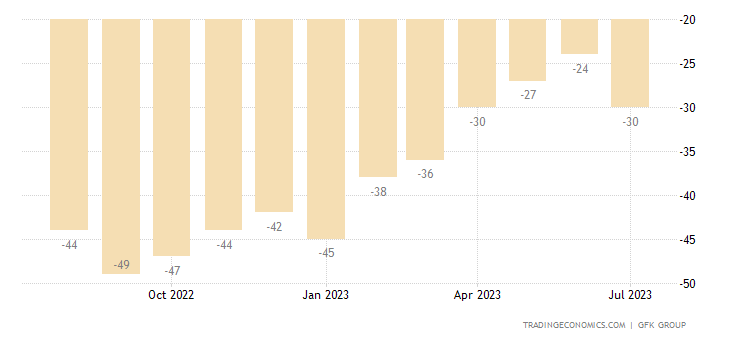

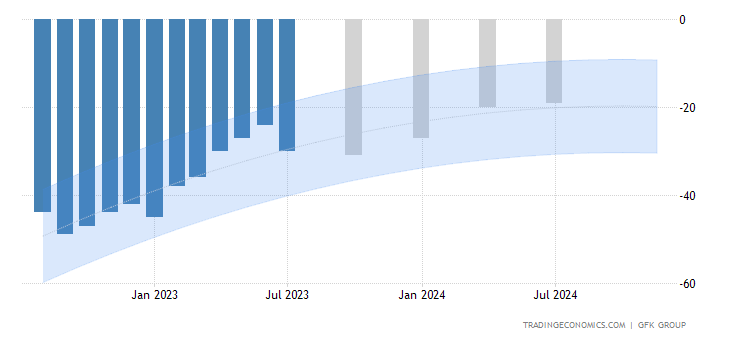

In July 2023, the GfK Consumer Confidence indicator in the United Kingdom experienced a significant downturn, falling to -30 from -24 in June. This decline marked the first time in six months, reflecting the impact of persistent inflation and surging interest rates on consumer sentiment. Forecasts for personal finances and the broader UK economy in the coming year witnessed declines of six and eight points, respectively, though remaining above year-ago levels. The major purchase index also plummeted by seven points, indicating a reduction in consumer spending on big-ticket items. As we delve into the underlying causes and potential ramifications of this decline, we also explore how it may influence UK stock signals and offer expert advice for investors navigating the uncertain financial landscape. UK stock signal

Factors Affecting Consumer Confidence:

The UK’s recent consumer confidence slump can be attributed to various factors that have exacerbated economic challenges. The most prominent among these are the persistently high inflation rates that have outpaced income growth, leading to a cost-of-living crisis. This phenomenon has not spared homeowners or renters, as rising interest rates have weighed heavily on both segments of the population. The six-point drop in the headline score signals a sudden collapse of resilience that prevailed during the first half of 2023. These developments have significant implications for investors looking for UK stock signals.

Impact on Personal Finances and the UK Economy:

The decline in consumer confidence has had discernible consequences for personal finances and the broader UK economy. The six-point decline in forecasts for personal finances indicates a growing concern among individuals about their ability to manage expenses and maintain financial stability in the face of inflationary pressures. Similarly, the eight-point drop in economic outlook forecasts signifies a pessimistic view of the UK’s economic prospects in the coming year. While these indices remain above year-ago levels, the extent of the decline highlights the growing uncertainty and volatility in the financial landscape.

Consumer Spending and Its Effect on the Stock Market:

The major purchase index’s seven-point fall has significant implications for consumer spending and the stock market. As consumers pare back spending on big-ticket items, industries reliant on such purchases may witness declines in revenue and profitability. This reduction in consumer spending could ripple through various sectors, impacting investor sentiment and UK stock signals. Investors should closely monitor the performance of companies in consumer-facing industries to gauge the potential impact on their portfolios.

Expert Advice for Investors: Given the prevailing economic challenges and uncertainties, investors seeking to navigate the UK stock market must adopt a cautious and informed approach. While consumer confidence has experienced a decline, it is essential to recognize that consumer sentiment can be subject to fluctuations influenced by various macroeconomic factors. As such, basing investment decisions solely on short-term consumer sentiment trends may not be prudent. Instead, investors should focus on conducting thorough research, analyzing fundamental company data, and considering long-term growth prospects.

Incorporating UK Stock Signals into Investment Strategies:

As investors weigh the impact of consumer confidence on the stock market, incorporating UK stock signals into their investment strategies becomes paramount. Analyzing market trends, sector-specific data, and company fundamentals can provide valuable insights for informed decision-making. Embracing technological advancements like artificial intelligence-driven analytics and machine learning algorithms can aid in identifying potential opportunities and risks in the market.

Conclusion: UK stock signal

The recent decline in the GfK Consumer Confidence indicator in the United Kingdom has raised concerns about the nation’s economic outlook and its potential impact on the stock market. The combination of persistent inflation, rising interest rates, and reduced consumer spending has contributed to this downturn. For investors seeking to navigate this uncertain financial landscape, relying on UK stock signals and adopting a prudent, research-driven approach will be key. As we move forward, vigilance and adaptability will be crucial traits for investors looking to capitalize on emerging opportunities and mitigate risks in the ever-evolving UK market.

Source: tradingeconomics.com

One thought on “UK Consumer Confidence Plummets Amidst Inflation and Rising Interest Rates: A Comprehensive Analysis for UK Stock Signal”