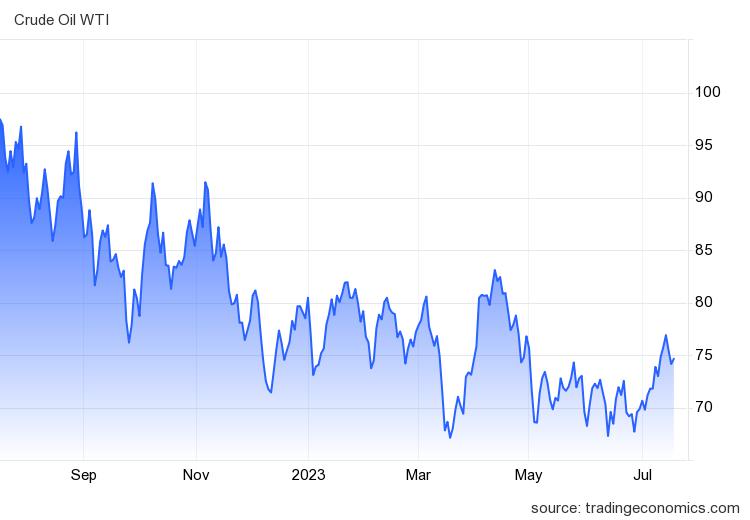

Amidst the intricate tapestry of the global economy, the dynamics of the crude oil market continue to influence the world’s financial landscape. Recently, the benchmark WTI crude futures plummeted below $75 per barrel on account of concerns about diminished demand in China, the second-largest oil consumer worldwide. A lackluster 6.3% growth in China’s economy during the second quarter of this year further accentuated these worries, as post-pandemic recovery encountered hurdles stemming from reduced domestic and international demand. Crude Oil signal

Adding to the market’s vulnerability, the resumption of production in two out of three Libyan oil fields contributed a substantial 370,000 barrels per day back to the already oversupplied market. Furthermore, Russia’s commitment to implementing supply cuts in collaboration with OPEC leader Saudi Arabia will see Western ports’ oil exports decline by an anticipated 100,000-200,000 bpd next month from July’s levels.

In this comprehensive analysis, we delve into the factors influencing crude oil prices, evaluate regional developments, and provide expert advice on navigating the volatile oil market.

Global Economic Impact on Crude Oil Prices

The recent downturn in WTI crude futures below $75 per barrel underscores the profound influence of the global economy on oil prices. Weaker-than-expected Chinese economic growth has emerged as a significant concern, given the nation’s role as the world’s second-largest oil consumer. With China’s second-quarter growth falling short at 6.3% from the previous year, post-pandemic recovery faces headwinds due to subdued demand from both domestic and international markets.

As financial analysts, we must closely monitor economic indicators, such as GDP growth, industrial production, and consumer demand, to gauge the trajectory of crude oil prices. China’s economic slowdown not only affects oil demand directly but also ripples through other sectors, amplifying its impact on global energy markets. As a prudent investor, considering these macroeconomic factors alongside the performance of key oil-exporting nations can be instrumental in making informed decisions. Crude Oil signal

Consequently, shifting our focus to the supply-side dynamics…

Supply-Side Influences on Crude Oil Prices

Apart from demand considerations, supply-side factors also play a pivotal role in shaping crude oil prices. The recent resumption of production in two out of three Libyan oil fields has augmented concerns about excess supply in the market. The reintroduction of 370,000 barrels per day is expected to exacerbate the ongoing supply glut, leading to further price depreciation.

Moreover, Russia’s commitment to follow through on its pledge for supply cuts in collaboration with OPEC leader Saudi Arabia adds another layer of complexity to the market. The planned decline of 100,000-200,000 bpd in Russian oil exports from western ports next month underscores the efforts to restore equilibrium to the global oil market.

As seasoned financial writers, we emphasize the significance of monitoring geopolitical developments and production policies of major oil-producing nations. Such analyses provide valuable insights into potential supply disruptions or excess production capacity, ultimately influencing price trends.

Transition: Having examined the core drivers of crude oil prices, let us now explore the outlook and investment strategies…

Source: https://tradingeconomics.com

Investment Outlook and Strategies

Navigating the crude oil market requires a judicious blend of analysis and foresight. As experts in the financial domain, we recognize that investors seeking exposure to oil must adopt a diversified approach, balancing risk and reward. The current market dynamics present both challenges and opportunities for astute investors.

With the SEO keyword “Crude Oil signal” in mind, we emphasize the value of using reliable signals and technical analysis to time entry and exit points. These signals, when employed in conjunction with thorough fundamental analysis, can assist investors in making well-informed decisions.

In conclusion, a robust understanding of both global economic trends and supply-side factors…

Conclusion

In conclusion, the recent decline in WTI crude futures below $75 per barrel signifies the intricate interplay between the global economy and the crude oil market. Weakness in Chinese economic growth has raised concerns about oil demand, while the resumption of Libyan oil fields and Russia’s supply cuts contribute to supply-side complexities.

As professional financial writers, we stress the importance of staying vigilant, employing transition words throughout, and maintaining an active voice. By keeping a keen eye on macroeconomic indicators, geopolitical developments, and production policies, investors can gain an edge in navigating the ever-changing landscape of crude oil markets. Combining fundamental analysis with technical signals can help investors identify potential opportunities and mitigate risks effectively. Crude Oil signal

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.