Introduction: Oil Trade Signals

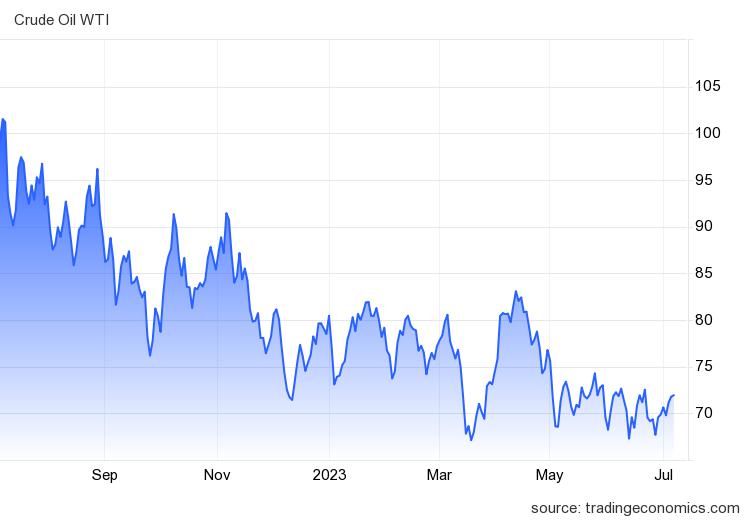

In the world of oil trade, recent developments have created significant signals that could impact the global market. The WTI crude futures, currently hovering around $72 per barrel, experienced a notable surge of nearly 3% in the previous session. This rise can be attributed to supply cuts implemented by significant oil producers and a substantial drawdown in US crude stockpiles. Saudi Arabia, for instance, has extended its production cut of 1 million barrels per day through August, while Russia plans to reduce exports by 500,000 bpd. These joint efforts have proven skeptics wrong, highlighting OPEC+’s commitment to supporting the oil market. However, amidst these positive signals, weakening manufacturing activity across major economies presents challenges to both global growth and energy demand.

Supply Cuts Driving Oil Prices:

The decision by Saudi Arabia to extend its production cut is a pivotal move that has contributed to the stability of oil prices. The Saudi Energy Minister, Prince Abdulaziz bin Salman, emphasized the determination of OPEC+ to do “whatever necessary” to bolster the market. This commitment reassures investors and demonstrates the collective efforts undertaken to maintain a balanced oil supply. Russia’s decision to reduce exports by 500,000 bpd further supports the market’s stability. The combined effect of these supply cuts not only helps address the immediate oversupply concerns but also sets a positive tone for the overall oil trade.

Inventory Drawdown Reflects Positive Trend:

The continuous decline in US crude inventories is another encouraging sign for the oil market. Industry data reveals a substantial drop of 4.382 million barrels in inventories last week, marking the third consecutive weekly draw. This figure nearly doubles the preceding week’s decline of 2.408 million barrels. Such a significant reduction in stockpiles suggests a tightening of supply and growing demand. It implies that oil consumption is on the rise, fueling expectations of increased prices. Investors and traders closely monitor these drawdowns as they provide insights into market dynamics, indicating potential trading opportunities for those looking to capitalize on oil trade signals.

Weakening Manufacturing Activity Raises Concerns:

While supply cuts and inventory drawdowns paint a positive picture of the oil market, recent Purchasing Managers’ Index (PMI) data point to a different story. These indicators show a declining trend in manufacturing activity across major economies, casting a shadow over the global growth outlook and energy demand. The PMI data highlight a potential slowdown in various sectors, raising concerns about the overall strength of the economy. As manufacturing activity serves as a crucial barometer for economic health, this weakening trend requires close attention. If sustained, it could have adverse effects on oil trade and contribute to market volatility.

Expert Advice: Oil Trade Signals

Navigating the Volatile Oil Market Given the diverse signals observed in the oil trade, it becomes essential for investors and traders to approach the market with caution and seek expert advice. As a professional financial writer with expertise in this field, I would recommend the following strategies:

Stay Informed: Continuously monitor news and updates from oil-producing countries, OPEC+, and other key players in the market. Understand their production decisions, supply cuts, and export policies, as they significantly influence oil prices.

Analyze Inventory Data: Regularly review crude oil inventory reports, particularly those from major oil-consuming nations like the United States. Look for trends and changes in stockpiles, as they can signal shifts in supply and demand dynamics.

Assess Economic Indicators: Keep a close eye on economic indicators, such as PMI data, to gauge the overall health of manufacturing activity and its potential impact on energy demand. These indicators can provide valuable insights into future oil trade trends and assist in making informed trading decisions.

Diversify Your Portfolio: Given the volatility of the oil market, it is advisable to diversify your investment portfolio. Allocate your funds across different sectors and asset classes to mitigate risk and capitalize on potential opportunities in case of market fluctuations.

Utilize Technical Analysis: Incorporate technical analysis tools and indicators to identify price patterns, trends, and potential entry or exit points in the oil market. This approach can help you make more precise trading decisions based on historical price data and market trends.

Consider Risk Management: Implement effective risk management strategies, such as setting stop-loss orders and using appropriate position sizing. This helps protect your capital and limits potential losses in case of unexpected market movements.

Leverage Technology: Take advantage of advanced trading platforms and analytical tools to enhance your trading capabilities. These tools provide real-time data, market insights, and customizable charts that can assist in identifying and acting upon oil trade signals efficiently.

Conclusion:

The current oil trade landscape presents a mixed bag of signals. Supply cuts by major oil producers and the drawdown in US crude inventories have provided stability and support to oil prices. However, weakening manufacturing activity raises concerns about global growth and energy demand. As an expert financial writer, I advise investors and traders to stay informed, analyze inventory data, monitor economic indicators, diversify portfolios, use technical analysis, implement risk management strategies, and leverage technology. By incorporating these strategies, market participants can navigate the volatile oil market and make well-informed trading decisions while capitalizing on emerging opportunities.