Introduction:

The Nikkei 225 Index, Japan’s leading benchmark, experienced a marginal decline of 0.5% on Monday, slipping below 33,600. The broader Topix Index also dropped 0.2%, settling at 2,295. This retreat followed record highs and a subsequent pullback in high-flying technology stocks. The Bank of Japan’s recent June meeting maintained its ultra-loose monetary policy to support a fragile economic recovery amid slowing global growth. Short-term interest rates remained at -0.1%, and 10-year bond yields were around 0%. Notable technology sector losses included SoftBank Group (-2.5%), Tokyo Electron (-2.3%), and Advantest (-2.5%). Heavyweights like Toyota Motor (-1.1%), Sony Group (-0.7%), and Mitsubishi Corp (-0.5%) also declined.

The Pullback in Technology Stocks: Nikkei 225 Trade Signal

Nikkei 225 Trade Signal and Topix Indices’ recent decline stemmed from a retreat in high-flying technology stocks. SoftBank Group, a prominent conglomerate, saw a significant decrease of 2.5%. Tokyo Electron, a leading semiconductor equipment manufacturer, dropped 2.3%, while Advantest, known for its advanced testing equipment, faced a setback of 2.5%. Renesas Electronics, Socionext, and Lasertec experienced declines of 2.8%, 2.3%, and 2% respectively. This correction indicates a temporary market adjustment, giving investors an opportunity to reassess their positions and identify potential entry points.

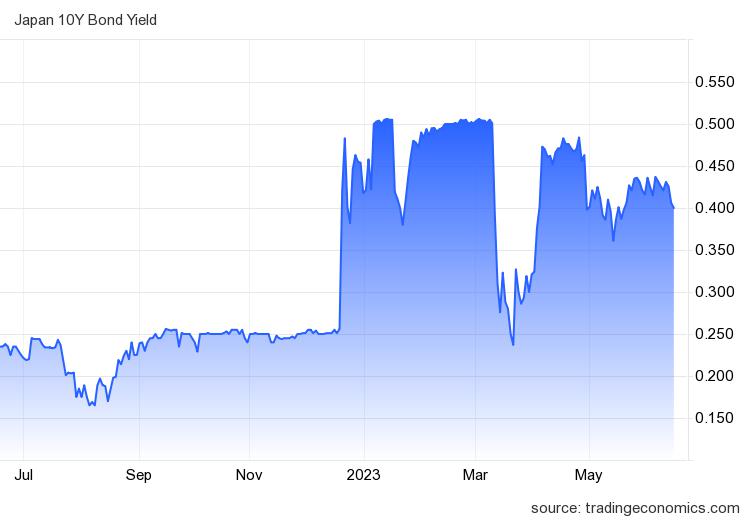

Bank of Japan’s Monetary Policy:

During the June meeting, the Bank of Japan (BoJ) maintained its ultra-loose monetary policy to support the fragile economic recovery. Short-term interest rates were at -0.1%, encouraging borrowing and spending, while 10-year bond yields were around 0%. This accommodative stance aims to promote lending, stimulate investment, and bolster economic activity. Monitoring any shifts in the BoJ’s monetary policy is crucial, as the interest rate and bond yield changes can significantly impact the financial markets and provide trading opportunities.

Impact on Heavyweights and Other Sectors:

The decline in the Nikkei 225 Index extended beyond the technology sector, impacting influential companies and sectors. Toyota Motor, a heavyweight in the automotive industry, observed a decline of 1.1%. Sony Group, known for its electronics and entertainment products, faced a more modest drop of 0.7%. Mitsubishi Corp, with interests across multiple industries, encountered a decline of 0.5%. This broader market correction highlights the interconnectedness of different sectors in the Japanese economy. Traders and investors should consider these fluctuations when formulating their investment strategies, and maintaining a balanced and diversified portfolio to mitigate risks.

Expert Advice: Assessing the Nikkei 225 Trade Signal:

As a financial expert, analyzing the Nikkei 225 trade signal allows for providing informed advice. The pullback in the technology sector presents potential opportunities for long-term investors. Thorough research and analysis are necessary before making any investment decisions. Assessing individual company fundamentals and their growth potential in relation to market trends can help identify promising investments. Monitoring the Bank of Japan’s monetary policy decisions and economic indicators provides valuable insights into the market direction. Employing risk management strategies, such as setting stop-loss orders and diversifying portfolios, can optimize returns. Consulting with a qualified financial advisor is recommended.

Conclusion:

The recent decline in the Nikkei 225 Index, driven by a pullback in technology stocks, emphasizes the dynamic nature of financial markets. Long-term investors may find opportunities amid the correction. The Bank of Japan’s commitment to supporting economic recovery through its monetary

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.