Introduction:

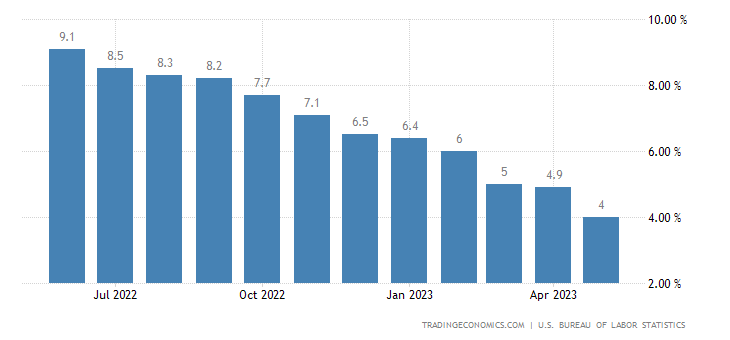

The latest data on consumer price inflation in the United States reveals a notable decline to 4.0 percent in May 2023, marking the lowest rate since March 2021. This figure slightly surpassed market expectations, which had anticipated a 4.1 percent rate. The downward trajectory can be attributed to a significant drop in energy prices, influencing the overall price level. Additionally, the core inflation rate, excluding volatile components like food and energy, witnessed a deceleration to 5.3 percent, reaching its lowest point since November 2021. This development reinforces the case for the Federal Reserve to contemplate pausing its current cycle of monetary tightening.

Trade Signal Forex Insights:

The declining consumer price inflation rate in May 2023 carries important implications for trade signals and market trends. As the overall price level stabilizes, traders and investors can anticipate shifts in various market sectors. Understanding and utilizing trade signals becomes crucial for making informed decisions and capitalizing on potential opportunities.

Embracing the human aspect of trade signals enables traders to transcend mere numbers and charts, forging a deep connection with the market and its intricate nuances. It empowers individuals to navigate the market landscape with finesse, seizing opportune moments and staying in tune with evolving trends. This human touch fosters a symbiotic relationship between traders and the market, enabling them to make decisions that align with their unique investment goals and aspirations.

Energy Prices and Market Impact:

The decline in consumer price inflation can be largely attributed to the slump in energy costs, which recorded a substantial 11.7 percent decrease in May, exceeding April’s decline of 5.1 percent. This downward trend in energy prices has consequential implications for the overall market. As energy costs represent a significant input for various industries, the decline may positively impact profit margins and potentially lead to increased consumer spending. In turn, this could stimulate economic growth and contribute to a more favorable trade signal for investors.

Food Inflation and Consumption Patterns:

In addition to energy, food inflation also played a role in shaping the overall consumer price index (CPI) for May 2023. Food inflation slowed to 6.7 percent from its previous level of 7.7 percent in April. This moderation in food price increases may indicate a stabilization in the supply chain disruptions experienced over recent months. As consumers typically allocate a significant portion of their income towards food consumption, the reduction in food inflation could potentially provide relief to household budgets and contribute to increased purchasing power. Such a shift in consumption patterns might be reflected in a positive trade signal, particularly for the food and beverage industry.

Impact on Specific Sectors: trade signal forex

Apart from energy and food, several other sectors experienced noteworthy price fluctuations. New vehicles, for instance, saw a smaller price increase of 4.7 percent in May compared to 5.4 percent in April. This moderation may be indicative of market dynamics, such as changes in consumer demand or supply chain adjustments. Similarly, apparel prices recorded a marginal decline from 3.6 percent to 3.5 percent, suggesting a potential stabilization in the fashion industry. Additionally, the housing sector witnessed a slight easing, with shelter prices decreasing from 8.1 percent to 8.0 percent. Similarly, transportation services exhibited a downward trend, with prices rising at a slower pace of 10.2 percent compared to 11.0 percent in the previous month. These sector-specific fluctuations contribute to the broader narrative of a moderating inflationary environment.

Monetary Policy Implications:

The latest consumer price inflation data has vital implications for the monetary policy decisions of the Federal Reserve. The persistent decline in inflation, coupled with the easing of core inflation, strengthens the argument for the central bank to pause its ongoing monetary tightening cycle. With inflation approaching the Federal Reserve’s target range, there may be room for policy adjustments to support economic stability and sustained growth. A cautious approach to monetary policy can allow the central bank to evaluate the potential impact of recent developments, including the decline in energy prices and moderated inflation rates across various sectors. By reassessing the timing and magnitude of future interest rate hikes, the Federal Reserve can adapt to evolving market conditions and seek to maintain a favorable trade signal.

In conclusion, trade signal forex let’s take a closer look at what the latest consumer price inflation data for May 2023 tells us about the United States. It’s like peeking into the wallet of everyday people and seeing how things are changing.

So, guess what? Inflation has gone down! Can you believe it? One of the main reasons behind this drop is the lower prices of energy. It’s like a weight being lifted off our shoulders, giving us a little extra breathing room in our budgets.

But wait, there’s more! When we dive into the details, we find that different things we buy are going through their price adventures. Imagine that! The cost of food, housing, transportation, clothing, and even cars has been on a rollercoaster ride. It’s like they’re playing a game of tug-of-war, constantly pulling in different directions.

Now, here’s the interesting part. All these changes in inflation and prices send us a message. It’s like a signal that tells investors what’s happening and how they should respond. It’s like a friendly nudge, whispering in their ears, “Hey, pay attention! Things are shifting, and it might affect your investments.”

So, as the Federal Reserve figures out its next steps, they need to consider this signal and make wise decisions. It’s like walking a tightrope, balancing between stability and adaptability. They want to keep our economy steady while keeping an eye on how different sectors and price fluctuations can impact our lives.

One thought on “Trade Signal Forex: US Consumer Price Inflation in May 2023: Implications for Monetary Policy and Market Trends”