Introduction

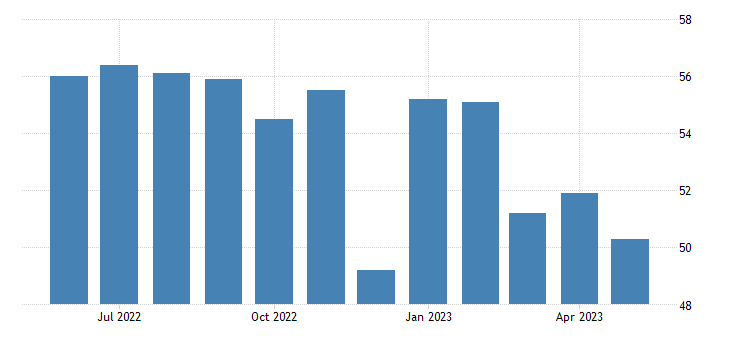

In May 2023, the Institute for Supply Management (ISM) Services Purchasing Managers’ Index (PMI) revealed a slight deceleration in the services sector, marking the fifth consecutive month of expansion but at the slowest pace in the ongoing sequence. The PMI fell to 50.3, down from 51.9 in April, indicating a modest growth rate. This report examines the key factors contributing to the overall performance of the services industry, highlighting areas of concern such as a slowdown in business activity, new orders, and employment contraction, while also noting improvements in supplier deliveries, capacity, inventories, and easing price pressures.

Summary

The ISM Services PMI for May 2023 indicates that the service sector is continuing to grow, albeit more slowly than it did the month before. The index dropped to 50.3, signaling a slight slowdown in growth. According to the report, there was a slowdown in company activity, fresh orders, and employment, which caused worries about the larger economy. On a good note, vendor deliveries improved, reflecting faster turnaround times, while ability and inventories saw good developments. Cost pressures also decreased, reaching their lowest point since May 2020. Respondents expressed security in the current business climate but expressed concern about the economy’s general sluggishness, as Anthony Nieves, Chair of the ISM Services Business Survey Committee, noted.

Slowing Business Activity and New Orders

The May 2023 ISM Services PMI report unveils a deceleration in business activity, with the index reading at 51.5, down from 52 in April. This slowdown in business expansion suggests a cautious approach by firms, possibly reflecting increased uncertainty and apprehension in the face of ongoing economic challenges. Furthermore, new orders experienced a more pronounced decline, falling to 52.9 from 56.1 in the previous month, indicating a weaker demand for services. This decline in new orders, coupled with slower business activity, suggests that companies are adopting a more cautious stance, potentially impacting future growth prospects.

Employment Contraction and Concerns about the Economy

A notable concern arising from the May PMI report is the contraction in employment within the services sector. The employment index dropped to 49.2, signaling a decline in hiring activity compared to the previous month’s reading of 50.8. The contraction in employment could be attributed to various factors, including the uncertainty surrounding the economic outlook, challenges in finding skilled labor, and the impact of ongoing supply chain disruptions.

Concerns about the overall health of the economy are raised by this drop in work, along with the downturn in business activity and new orders. It suggests that companies are being more selective about the people they hire, probably as a result of the impending prolonged economic slowdown. Given that job and income growth are important factors in consumer confidence and purchasing power, these precautionary measures may have an impact on consumer spending.

Supplier Deliveries and Capacity Improvements

Amidst the slowdown in several key indicators, there were some positive developments observed in the May ISM Services PMI report. Supplier deliveries, for instance, showed improvement, with a reading of 47.7, up from 48.6 in April. The increase in this index suggests that suppliers were able to expedite their deliveries, potentially enhancing operational efficiency for businesses in the services sector. Quicker supplier deliveries can have a positive impact on the overall supply chain, allowing companies to respond more effectively to customer demand and potentially bolstering their competitive position.

Another encouraging aspect revealed in the report is the improvement in capacity. With the capacity index indicating positive growth, businesses may have increased their ability to handle higher production volumes or customer demand. This could be a result of investments in infrastructure, technology, or process optimization. Improvements in capacity can enhance a company’s ability to meet customer needs and seize opportunities for growth, laying a foundation for future expansion.

Inventories Rebound and Easing Price Pressures

The May PMI report indicates a rebound in inventories, with the index rising to 58.3 from 47.2 in April. This substantial increase suggests that businesses have replenished their stock levels, potentially in response to improved business sentiment or expectations of increased demand. The rebound in inventories is a positive sign, as it indicates a more optimistic outlook among businesses in the services sector.

Furthermore, the report reveals a decline in price pressures. The index for price pressures eased to 56.2 from 59.6, marking the lowest level since May 2020. The easing of price pressures may reflect a decrease in input costs or a reduction in pricing power for service providers. This development can benefit businesses by alleviating some cost pressures and potentially enhancing their competitiveness in the market.

In summary

May 2023 ISM Services PMI report paints a picture of slower expansion within the services sector, marked by declines in business activity, new orders, and employment. These indicators raise concerns about the overall economic outlook, signaling potential challenges ahead. However, it’s important to note that the report also highlights some positive aspects, such as improvements in supplier deliveries, capacity, inventories, and easing price pressures. These positive developments may provide a glimmer of hope amidst the slowdown.

Looking ahead, the next few months will be pivotal in determining whether the current slowdown in the services sector is merely a temporary setback or a more persistent trend. The global economic landscape will play a crucial role in shaping the future trajectory of the services industry. Key factors to watch include the release of the Non-Farm Payrolls Report, China’s economic performance, and trade signals. These elements will provide valuable insights into the broader economic conditions and their impact on the services sector.

As businesses navigate these challenging times, it is crucial to monitor the evolving economic indicators and adapt strategies accordingly. Flexibility, innovation, and a proactive approach will be essential for businesses to weather the storm and position themselves for long-term success. By staying attuned to market dynamics and leveraging opportunities as they arise, businesses can navigate uncertainties and emerge stronger in the evolving services landscape.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.